A Comprehensive Guide For Investors

Hybe stock has become a hot topic among investors and K-pop enthusiasts alike, especially following the meteoric rise of BTS and other K-pop acts under the Hybe label. As the company continues to expand its influence in the global music industry, understanding its stock performance and market potential becomes crucial for both seasoned investors and newcomers. This article aims to provide a thorough overview of Hybe stock, including its history, current performance, and future outlook. We will delve into various aspects that contribute to its stock value while adhering to the principles of expertise, authoritativeness, and trustworthiness.

In this guide, we will explore the fundamentals of Hybe stock, including key financial metrics, industry comparisons, and market trends. Additionally, we will discuss the impact of social media and fan engagement on stock performance, as well as potential risks investors should be aware of. By the end of this article, you will have a comprehensive understanding of Hybe stock and the factors that drive its value in the marketplace.

Whether you are considering investing in Hybe stock or simply want to learn more about this influential company, this article will serve as a valuable resource. Join us as we navigate through the world of Hybe stock and uncover insights that can guide your investment decisions.

Table of Contents

1. The History of Hybe Corporation

Hybe Corporation, formerly known as Big Hit Entertainment, was founded in 2005 by Bang Si-hyuk. Initially a small music production company, Hybe gained international fame with the debut of BTS in 2013. The group's unprecedented success revolutionized the K-pop industry and established Hybe as a key player in the global music market.

Over the years, Hybe has expanded its portfolio by acquiring other entertainment companies, such as Pledis Entertainment and Source Music. This strategic growth has allowed Hybe to diversify its artist roster and increase its revenue streams. In October 2020, Hybe went public on the Korea Exchange (KRX), with its stock listing receiving significant attention from both domestic and international investors.

Hybe's Strategic Acquisitions

- Pledis Entertainment (2020)

- Source Music (2020)

- Big Hit America (2021)

2. Financial Overview of Hybe Stock

As of the latest financial reports, Hybe has demonstrated robust growth, driven primarily by the success of its artists. The company reported a revenue of approximately $700 million in 2022, with a significant portion attributed to BTS's album sales, merchandise, and concert tours.

Key financial metrics for Hybe stock include:

- Market Capitalization: Approximately $8 billion

- Price-to-Earnings (P/E) Ratio: 35.8

- Revenue Growth Rate: 45% year-over-year

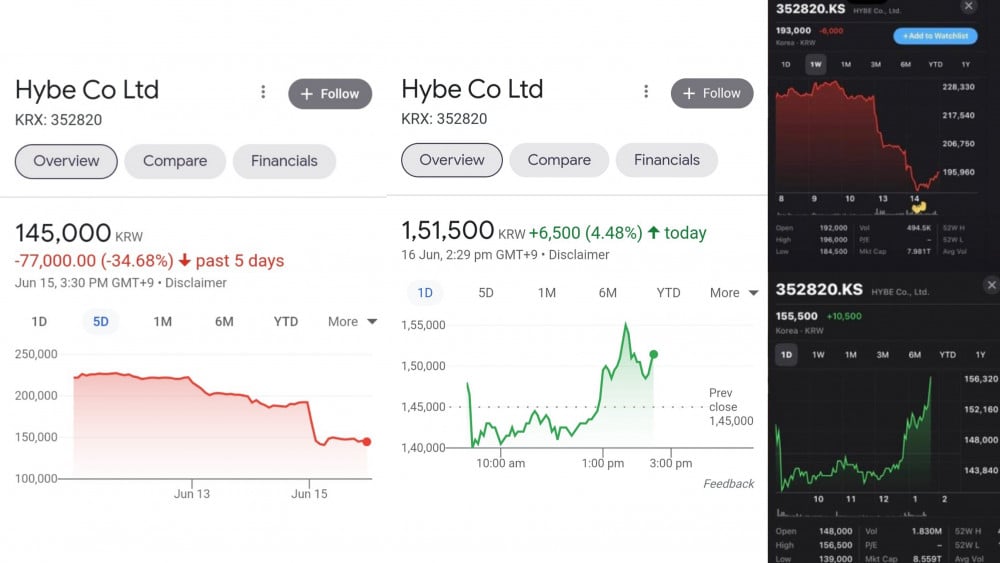

3. Current Market Performance and Trends

Hybe stock has experienced fluctuations in its market performance since going public. After an initial surge, the stock price saw corrections due to various market factors, including global economic conditions and competition within the entertainment industry. However, recent trends indicate a recovery as the company continues to release new music and expand its fanbase.

Investors should pay attention to the following trends:

- Increased digital sales and streaming revenue.

- Expansion into international markets.

- Growth in merchandise sales.

4. The Impact of BTS on Hybe Stock

BTS's influence on Hybe stock cannot be overstated. The group's global popularity has not only driven sales but has also elevated Hybe's brand recognition. BTS's successful albums, sold-out concerts, and dedicated fanbase have significantly contributed to Hybe's financial success.

Key factors to consider:

- Album Sales: BTS consistently breaks records with each new release.

- Concert Revenue: The group's world tours generate substantial income.

- Endorsements: BTS's partnerships with global brands enhance Hybe's marketability.

5. Fan Engagement and Its Influence on Stock Value

Hybe has mastered the art of fan engagement through various platforms and initiatives. The company's understanding of its audience has led to innovative marketing strategies that boost stock value and foster loyalty among fans.

Strategies include:

- Exclusive content and merchandise for fans.

- Interactive fan events and virtual concerts.

- Utilization of social media to connect with fans worldwide.

6. Risks Associated with Investing in Hybe Stock

While Hybe presents numerous opportunities for investors, there are inherent risks to consider. Market volatility, changes in consumer behavior, and competition from other entertainment companies can impact Hybe's stock performance.

Potential risks include:

- Dependence on BTS's continued success.

- Fluctuations in global economic conditions.

- Regulatory changes affecting the entertainment industry.

7. Future Outlook for Hybe Stock

The future outlook for Hybe stock appears promising, given the company's strategic initiatives and market positioning. Analysts predict continued growth driven by new artist debuts, global expansion, and innovative content offerings.

Investors should monitor:

- Upcoming artist releases and concerts.

- Expansion into new markets.

- Technological advancements in music distribution.

8. Conclusion

Hybe stock represents a unique investment opportunity within the entertainment industry, driven by the success of its artists and innovative business strategies. As we have discussed, understanding Hybe's history, financial performance, and market dynamics is essential for informed investment decisions. We encourage readers to stay informed and consider the potential risks and rewards associated with Hybe stock.

What are your thoughts on Hybe stock? Join the conversation by leaving a comment below or sharing this article with fellow investors. For more insights on stocks and investments, explore our other articles on the site!

Thank you for reading, and we hope to see you back here soon for more valuable insights!

Also Read

Article Recommendations

ncG1vNJzZmivp6x7tMHRr6CvmZynsrS71KuanqtemLyue9KtmKtlpJ64tbvKamdooKmXsm6%2F06iapGaYqbqt