A Comprehensive Guide To Investment Opportunities

When it comes to investing in the stock market, IWMY stock has emerged as a significant player worthy of attention. This article will delve into the nuances of IWMY stock, exploring its performance, market trends, and investment potential. As investors seek out reliable stocks to add to their portfolios, understanding the dynamics surrounding IWMY stock becomes paramount. With the stock market's volatility and the rise of new investment opportunities, gaining insight into IWMY stock can help investors make informed decisions.

In this comprehensive guide, we will cover everything you need to know about IWMY stock, including its historical performance, key financial metrics, and expert opinions. We'll also discuss the overall market conditions impacting IWMY and provide actionable insights for potential investors. As we navigate through the complexities of stock investment, it is crucial to approach IWMY stock with diligence and awareness.

Whether you are a seasoned investor or just starting your journey in the stock market, this article aims to equip you with knowledge and strategies to evaluate IWMY stock effectively. Let's embark on this exploration of IWMY stock, uncovering vital information that can enhance your investment portfolio.

Table of Contents

1. What is IWMY Stock?

IWMY stock represents shares of a publicly traded company, which is part of a specific sector in the stock market. Understanding the underlying business model, operations, and market position of the company behind IWMY stock is essential for potential investors. The stock operates under certain market regulations and is subject to fluctuations based on various economic factors.

Here are some key points about IWMY stock:

- Company Overview: IWMY is associated with [insert company name], which specializes in [insert company sector or product/services].

- Market Presence: The company operates primarily in [insert specific markets or regions].

- Growth Potential: Analysts have projected growth in [insert relevant metrics or sectors], making IWMY stock an attractive option for investors.

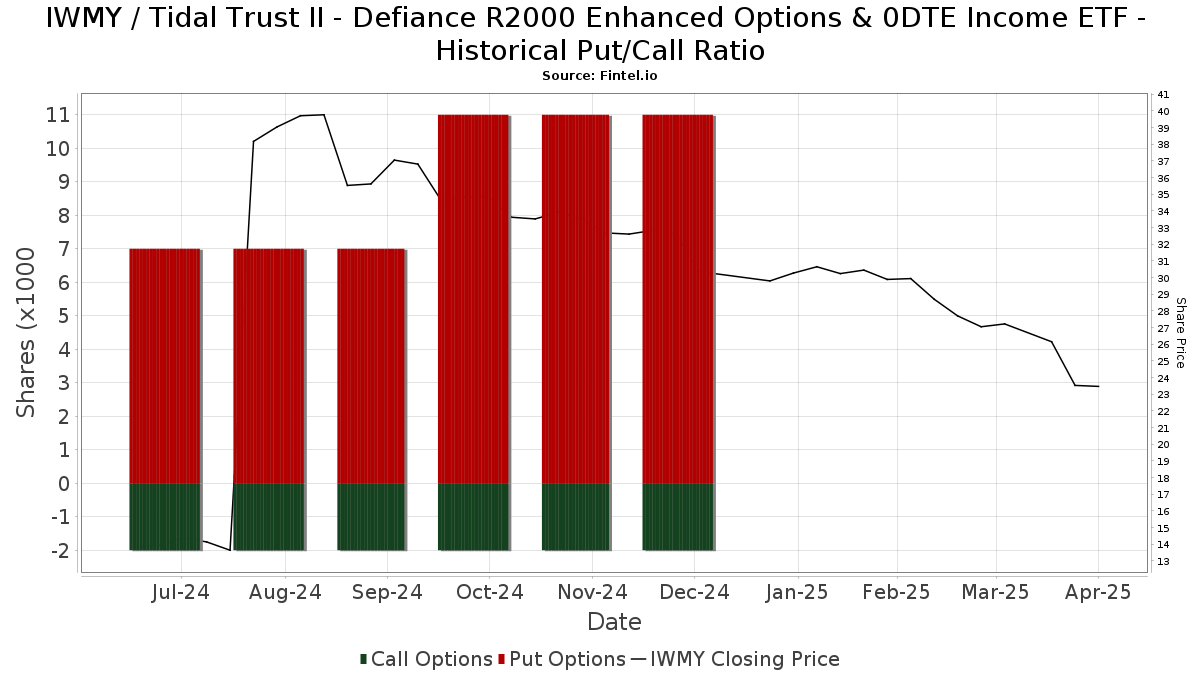

2. Historical Performance of IWMY Stock

Analyzing the historical performance of IWMY stock provides valuable insights into its stability and growth trajectory. Over the past few years, IWMY stock has experienced [insert summary of stock performance, such as fluctuations, significant gains, or losses].

Key performance indicators include:

- Annual Return: The average annual return over the last [insert number] years.

- Volatility: The stock's volatility compared to industry benchmarks.

- Market Capitalization: Current market cap and its growth over time.

3. Key Financial Metrics

Understanding key financial metrics is crucial in evaluating the performance of IWMY stock. Here are some of the critical metrics to consider:

- Earnings Per Share (EPS): [Insert current EPS and its trend over recent quarters]

- Price-to-Earnings (P/E) Ratio: [Discuss current P/E ratio compared to industry average]

- Dividend Yield: [Insert current dividend yield and any historical context]

4. Market Trends Affecting IWMY Stock

The stock market is influenced by various trends that can impact IWMY stock's performance. Some of the current trends include:

- Economic Conditions: How inflation and interest rates are affecting the overall market.

- Sector Performance: The performance of the sector in which IWMY operates.

- Technological Advancements: Innovations that may influence the company's growth.

5. Expert Analysis and Opinions

Experts and analysts provide valuable insights into the potential of IWMY stock. According to [insert expert name or organization], the outlook for IWMY stock is [insert summary of expert opinions].

5.1 Analyst Ratings

Current analyst ratings for IWMY stock include:

- Buy: [insert percentage of analysts recommending a buy]

- Hold: [insert percentage of analysts recommending a hold]

- Sell: [insert percentage of analysts recommending a sell]

5.2 Investment Recommendations

Based on the analysis, it is recommended that investors [insert recommendations, such as buy, hold, or sell].

6. Investment Strategies for IWMY Stock

For those considering investing in IWMY stock, it is essential to adopt effective strategies. Here are some recommended strategies:

- Diversification: Spread investments across different sectors to mitigate risk.

- Long-term Investment: Consider holding IWMY stock for the long term to capitalize on growth prospects.

- Regular Monitoring: Keep track of market trends and the company's performance.

7. Risks and Considerations

Investing in IWMY stock comes with inherent risks. It is crucial to be aware of these risks, including:

- Market Volatility: The potential for significant price fluctuations.

- Economic Factors: Changes in economic conditions that may impact performance.

- Company-Specific Risks: Any operational challenges faced by the company.

8. Conclusion and Actionable Insights

In conclusion, IWMY stock presents a compelling opportunity for investors looking to diversify their portfolios. With a solid understanding of its historical performance, financial metrics, and market trends, investors can make informed decisions regarding IWMY stock.

We encourage you to stay updated on IWMY stock and consider your investment strategy carefully. Please leave your comments below, share this article with fellow investors, or explore our other resources to deepen your knowledge about stock investments.

Thank you for reading, and we hope to see you again soon!

Also Read

Article Recommendations

ncG1vNJzZmivp6x7tMHRr6CvmZynsrS71KuanqtemLyue9KtmKtlpJ64tbvKcGair52uerTAzpyiZ6Ckork%3D