A Comprehensive Guide To Services And Community Impact

Ridgewood Savings Bank has established itself as a cornerstone financial institution in New York, providing a range of banking services tailored to meet the needs of individuals and businesses alike. Founded in 1921, it has built a reputation for reliability and customer service excellence. In this article, we will explore the bank's history, the services it offers, its role in the community, and what sets it apart from other financial institutions.

As we delve into the various aspects of Ridgewood Savings Bank, we will also highlight its commitment to the principles of security, transparency, and community engagement. Whether you are a potential customer or someone interested in the banking sector, this guide will provide valuable insights into what makes Ridgewood Savings Bank a trusted choice.

In addition, we will discuss the bank's financial health, customer service ratings, and how it compares to other local banks. For anyone looking to open an account or seeking banking solutions, understanding Ridgewood Savings Bank's offerings can be a significant step in making informed financial decisions.

Table of Contents

1. History of Ridgewood Savings Bank

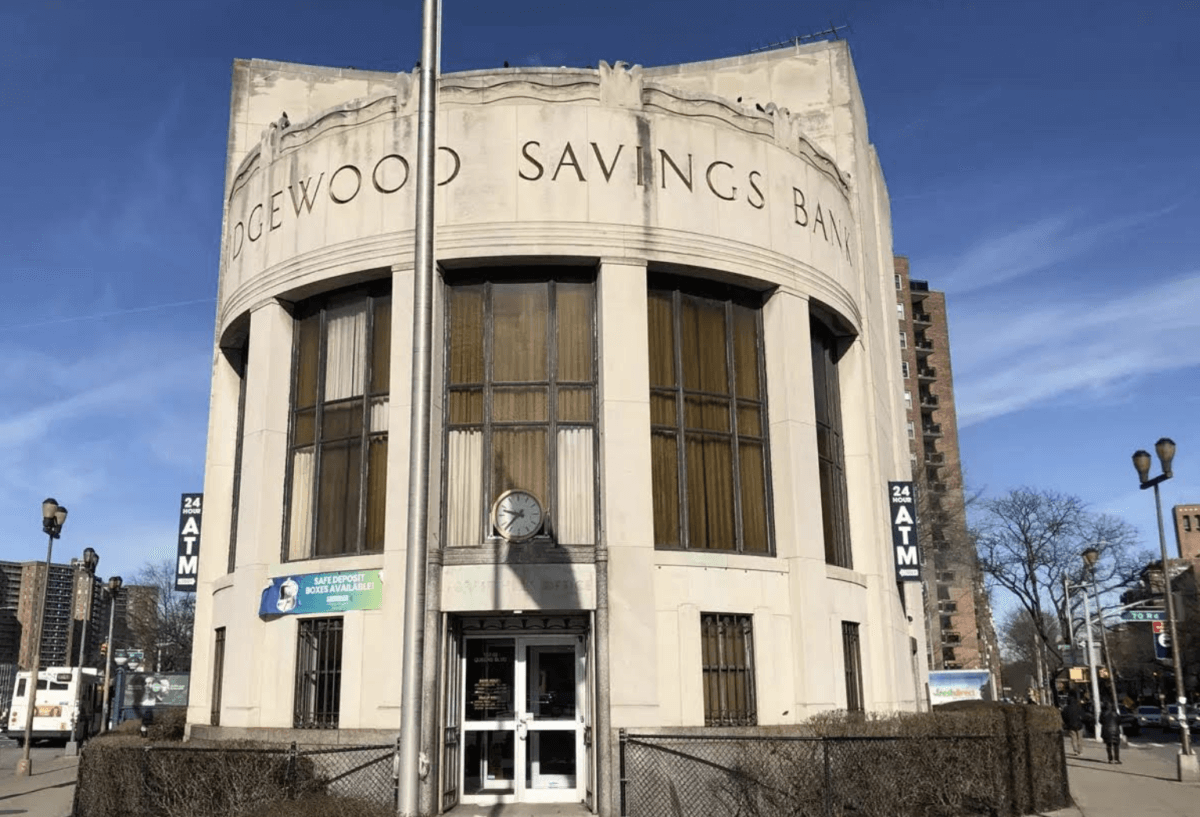

Ridgewood Savings Bank was founded in 1921 in Ridgewood, Queens, New York. Its initial purpose was to provide affordable savings and loan services to the local community. Over the decades, the bank has expanded its footprint, becoming a prominent player in the New York banking landscape.

The bank has undergone several changes throughout its history, including the transition from a traditional savings bank to a modern financial institution offering a variety of services. Today, Ridgewood Savings Bank continues to uphold its mission of community support while adapting to the evolving financial needs of its customers.

Key Milestones

- 1921: Ridgewood Savings Bank was established.

- 1970s: Expansion into multiple branches across New York City.

- 2000s: Introduction of online banking services.

- 2020: Celebrated 99 years of service to the community.

2. Services Offered by Ridgewood Savings Bank

Ridgewood Savings Bank offers a wide array of services designed to cater to the financial needs of individuals and businesses. Here are the main categories of services:

Personal Banking Services

- Checking Accounts

- Savings Accounts

- Certificates of Deposit (CDs)

- Personal Loans

- Mortgages

Business Banking Services

- Business Checking Accounts

- Business Savings Accounts

- Commercial Loans

- Merchant Services

- Lines of Credit

Online and Mobile Banking

With the rise of digital banking, Ridgewood Savings Bank has embraced technology by offering robust online and mobile banking solutions. Customers can easily manage their accounts, pay bills, and transfer funds at their convenience.

3. Community Impact and Involvement

Ridgewood Savings Bank is deeply committed to its community. The bank actively participates in various community outreach programs and initiatives aimed at improving the quality of life for residents in the areas it serves.

Community Programs

- Financial literacy workshops for adults and youth.

- Support for local charities and non-profits.

- Sponsorship of community events and activities.

Through these initiatives, Ridgewood Savings Bank aims to empower individuals with the knowledge and resources they need to achieve financial success.

4. Financial Health of Ridgewood Savings Bank

Understanding the financial health of a bank is crucial for customers. Ridgewood Savings Bank has consistently demonstrated strong financial performance, marked by solid asset growth and a stable capital position.

Key Financial Metrics

- Total Assets: Over $2 billion

- Capital Ratio: Above the regulatory minimums

- Loan-to-Deposit Ratio: Healthy balance indicating efficient use of deposits

These metrics show that Ridgewood Savings Bank is well-positioned to meet its obligations while continuing to provide quality services to its customers.

5. Customer Service Ratings

Excellent customer service is a hallmark of Ridgewood Savings Bank. The bank takes pride in its ability to provide personalized service to its customers, whether in-branch or through digital channels.

Customer Feedback

- High satisfaction ratings in customer surveys.

- Positive reviews on online platforms.

- Responsive support team available via phone and online chat.

These factors contribute to the bank’s reputation as a trustworthy financial institution.

6. Comparison with Other Local Banks

When considering a bank, it is essential to compare its offerings with those of competitors. Ridgewood Savings Bank stands out for its community focus, range of services, and competitive interest rates.

Advantages Over Competitors

- Community involvement and support.

- Personalized customer service approach.

- Competitive loan and deposit rates.

These advantages position Ridgewood Savings Bank as a preferred choice for many customers in the region.

7. Data and Statistics

To further illustrate the bank's impact, here are some statistics:

- Over 10 branches in New York City.

- More than 50,000 customer accounts.

- Annual community contributions exceeding $1 million.

Such data highlights the significant role Ridgewood Savings Bank plays in the financial landscape of New York.

8. Conclusion

In summary, Ridgewood Savings Bank is a reliable financial institution that has served the New York community for over 100 years. Its diverse range of services, commitment to community involvement, and strong financial health make it a top choice for both personal and business banking needs.

We encourage readers to consider Ridgewood Savings Bank for their banking needs. For more information, visit their website or contact a local branch. We invite you to leave your thoughts in the comments below or share this article with others who may find it helpful.

Thank you for reading, and we hope to see you back on our site for more informative articles!

Also Read

Article Recommendations

ncG1vNJzZmivp6x7tMHRr6CvmZynsrS71KuanqtemLyue9Oop6edp6h%2BeXvRopugnaekvKV50pqtoqaXqHqjrc2kZaGsnaE%3D