Chase Bank ATM Glitch: A Comprehensive Analysis

In recent times, the Chase Bank ATM glitch has garnered significant attention from customers and financial analysts alike. This unexpected issue raised concerns about the reliability of banking services and the security of customer funds. With the increasing reliance on digital banking solutions, understanding this glitch is crucial for both existing and potential customers of Chase Bank.

In this article, we will delve into the details of the Chase Bank ATM glitch, exploring its causes, implications, and how it has affected customers. We will also provide insights into the bank's response and measures taken to prevent future occurrences. Whether you are a Chase Bank customer or simply interested in banking technology, this article aims to equip you with valuable information about this recent phenomenon.

By the end of this article, you will have a comprehensive understanding of the Chase Bank ATM glitch and its impact on the banking industry. So, let's explore the intricacies of this situation and what it means for customers and the broader financial landscape.

Table of Contents

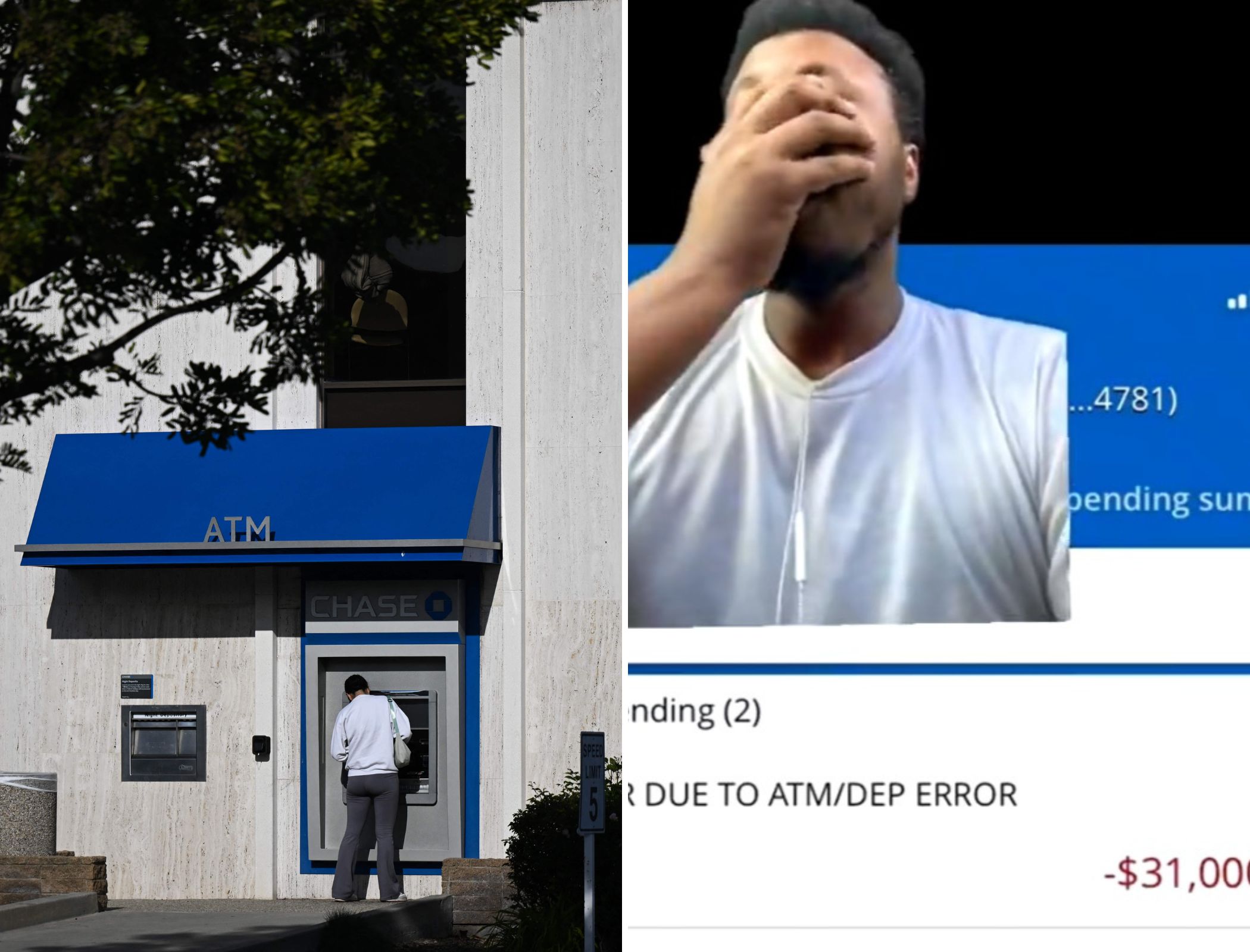

What is the Chase Bank ATM Glitch?

The Chase Bank ATM glitch refers to a technical error that occurred in the bank's ATM network, resulting in various issues for customers. This glitch manifested in several ways, including:

- Incorrect account balances displayed at ATMs.

- Failed transactions or withdrawals that were not processed correctly.

- Delayed updates to account information.

This glitch raised alarms among customers who rely on ATMs for their daily banking needs, as it jeopardized their access to funds and overall banking experience.

Causes of the Glitch

Understanding the causes of the Chase Bank ATM glitch is essential in mitigating future issues. The glitch was attributed to several factors:

- Software Bugs: Technical errors in the ATM software led to incorrect data being displayed.

- Network Issues: Connectivity problems between ATMs and the bank's servers contributed to delayed transaction processing.

- System Maintenance: Routine maintenance activities may have inadvertently triggered the glitch.

These factors combined created a perfect storm, leading to widespread glitches across multiple ATMs in various locations.

Implications for Customers

The Chase Bank ATM glitch had significant implications for customers, affecting their confidence in the bank's services. Some of the key implications included:

- Loss of Trust: Customers began to question the reliability of Chase Bank's ATM services.

- Financial Inconvenience: Many customers faced difficulties accessing their funds during the glitch, leading to frustration and potential financial strain.

- Increased Complaints: The volume of customer complaints surged as individuals sought clarification and resolution from the bank.

Chase Bank's Response

In response to the ATM glitch, Chase Bank took several steps to address the issue and reassure customers:

- Public Acknowledgment: The bank publicly acknowledged the glitch and communicated with customers about the situation.

- Technical Fixes: Chase implemented immediate technical fixes to resolve the software bugs and restore normal operations.

- Customer Support Enhancement: The bank increased customer support efforts to address concerns and inquiries from affected customers.

Preventative Measures

To prevent future occurrences of similar glitches, Chase Bank has committed to implementing several preventative measures:

- Enhanced Software Testing: The bank plans to strengthen their software testing protocols to catch potential bugs before they affect customers.

- Improved Network Stability: Upgrades to network infrastructure will be made to ensure reliable connectivity between ATMs and bank servers.

- Regular Maintenance Schedules: The bank will establish more systematic maintenance schedules to minimize the risk of unintentional disruptions.

Customer Experiences

Customers' experiences during the Chase Bank ATM glitch varied widely. While some reported minor inconveniences, others faced significant challenges. Key experiences included:

- Frustration: Many customers expressed frustration over the inability to access their funds or receive accurate account information.

- Support Engagement: Customers who reached out to customer support often received timely assistance, which helped mitigate some of their concerns.

- Community Impact: The glitch prompted discussions within communities about the reliability of digital banking solutions.

Future of Banking Technology

The Chase Bank ATM glitch serves as a reminder of the importance of robust technology in banking. As the industry continues to evolve, several trends are emerging:

- Increased Automation: Banks are investing in automated systems to enhance efficiency and reduce human error.

- Blockchain Technology: The adoption of blockchain technology may improve security and transparency in banking transactions.

- Customer-Centric Solutions: Financial institutions are focusing on developing solutions that prioritize customer experience and trust.

Conclusion

In summary, the Chase Bank ATM glitch highlighted critical vulnerabilities in the banking system and its reliance on technology. Customers experienced a range of challenges, from loss of trust to financial inconvenience. However, Chase Bank's proactive response and commitment to enhancing their systems and customer support offer hope for a more reliable banking experience in the future.

We encourage you to share your thoughts or experiences related to the Chase Bank ATM glitch in the comments below. Also, feel free to explore our other articles for more insights into banking technology and financial services.

Thank you for reading! We hope to see you back on our site for more informative content.

Also Read

Article Recommendations

ncG1vNJzZmivp6x7tMHRr6CvmZynsrS71KuanqtemLyue9WiqZqko6q9pr7SrZirq2lksKmt0p5km5meoHqiwMxmnqWhpJi1b7TTpqM%3D