CNN Fear And Greed Index: Understanding Market Sentiment

The CNN Fear and Greed Index is a crucial tool for investors seeking to gauge market sentiment. It provides insights into the emotions driving market movements, whether fear or greed, which can significantly impact investment decisions. In a world where market fluctuations are common, understanding the underlying emotions can offer a competitive edge. This article delves deep into the CNN Fear and Greed Index, explaining its components, significance, and how investors can utilize it effectively.

Investors often find themselves in a whirlwind of emotions when navigating the stock market. The fear of losing money can lead to panic selling, while the greed for profits may push individuals to take unnecessary risks. The CNN Fear and Greed Index quantifies these emotions, helping investors make informed decisions. This index ranges from 0 to 100, with lower values indicating fear and higher values reflecting greed.

In this article, we will explore the various aspects of the CNN Fear and Greed Index. We will discuss its methodology, the factors influencing its readings, and how it can be integrated into an investment strategy. By the end, readers will have a comprehensive understanding of this index and its relevance in today’s financial landscape.

Table of Contents

What is the CNN Fear and Greed Index?

The CNN Fear and Greed Index is a sentiment analysis tool that measures the level of fear or greed in the stock market. Developed by CNN Business, it is designed to help investors make sense of market trends and emotional drivers. The index is based on a combination of various indicators that reflect market sentiment, and it is updated daily.

How is the CNN Fear and Greed Index Calculated?

The CNN Fear and Greed Index is calculated using seven different indicators, each contributing to the overall score. These indicators are:

- Stock Price Momentum: Measures the strength of the market’s current trend compared to past performance.

- Stock Price Strength: Evaluates the number of stocks hitting new highs versus new lows.

- Market Volatility: Assesses the level of market volatility and its correlation with fear.

- Put and Call Options: Analyzes the volume of options traded to gauge investor sentiment.

- Junk Bond Demand: Looks at the demand for riskier investments as a sign of greed.

- Market Breadth: Measures the overall health of the market based on the number of advancing versus declining stocks.

- Safe Haven Demand: Evaluates the performance of safe-haven assets like gold and treasury bonds.

Components of the CNN Fear and Greed Index

The components of the CNN Fear and Greed Index provide a detailed insight into the emotions influencing the market. Each component serves as a barometer for investor sentiment:

1. Stock Price Momentum

This component assesses how stocks are performing relative to their historical averages. A high momentum indicates a bullish market, while low momentum suggests bearish sentiment.

2. Stock Price Strength

By analyzing the ratio of new highs to new lows, this component helps gauge whether more stocks are experiencing upward or downward trends.

3. Market Volatility

High volatility is often associated with fear, while low volatility indicates a stable, greed-driven market.

4. Put and Call Options

This measure indicates whether investors are hedging against market declines or betting on further increases.

Importance of the CNN Fear and Greed Index

The CNN Fear and Greed Index serves several essential functions for investors:

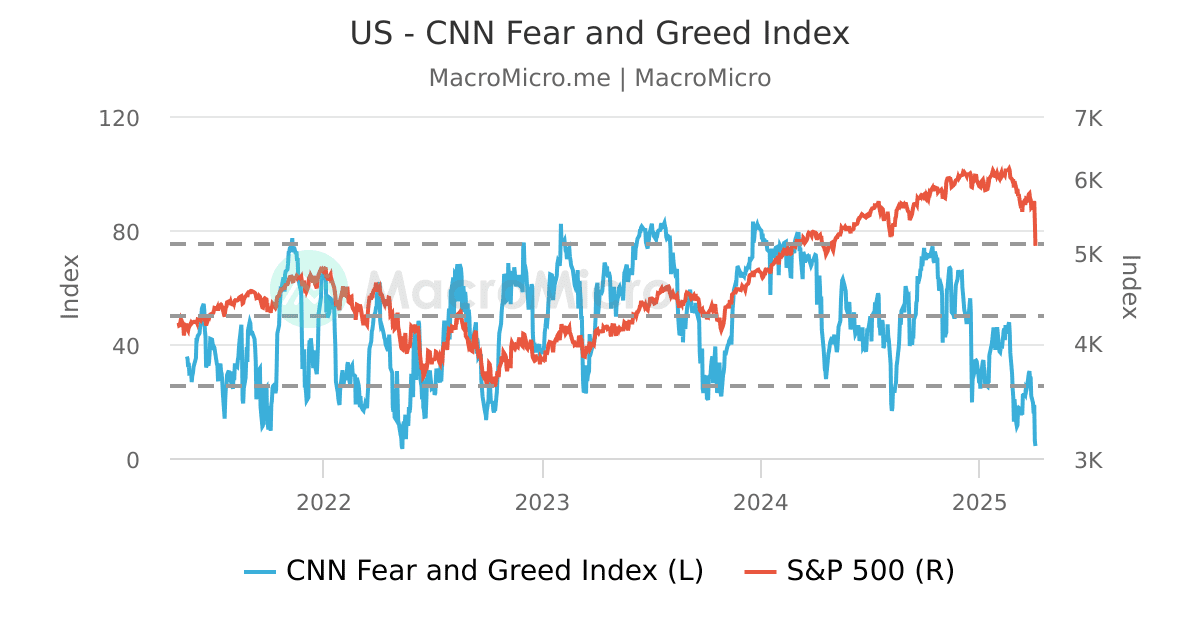

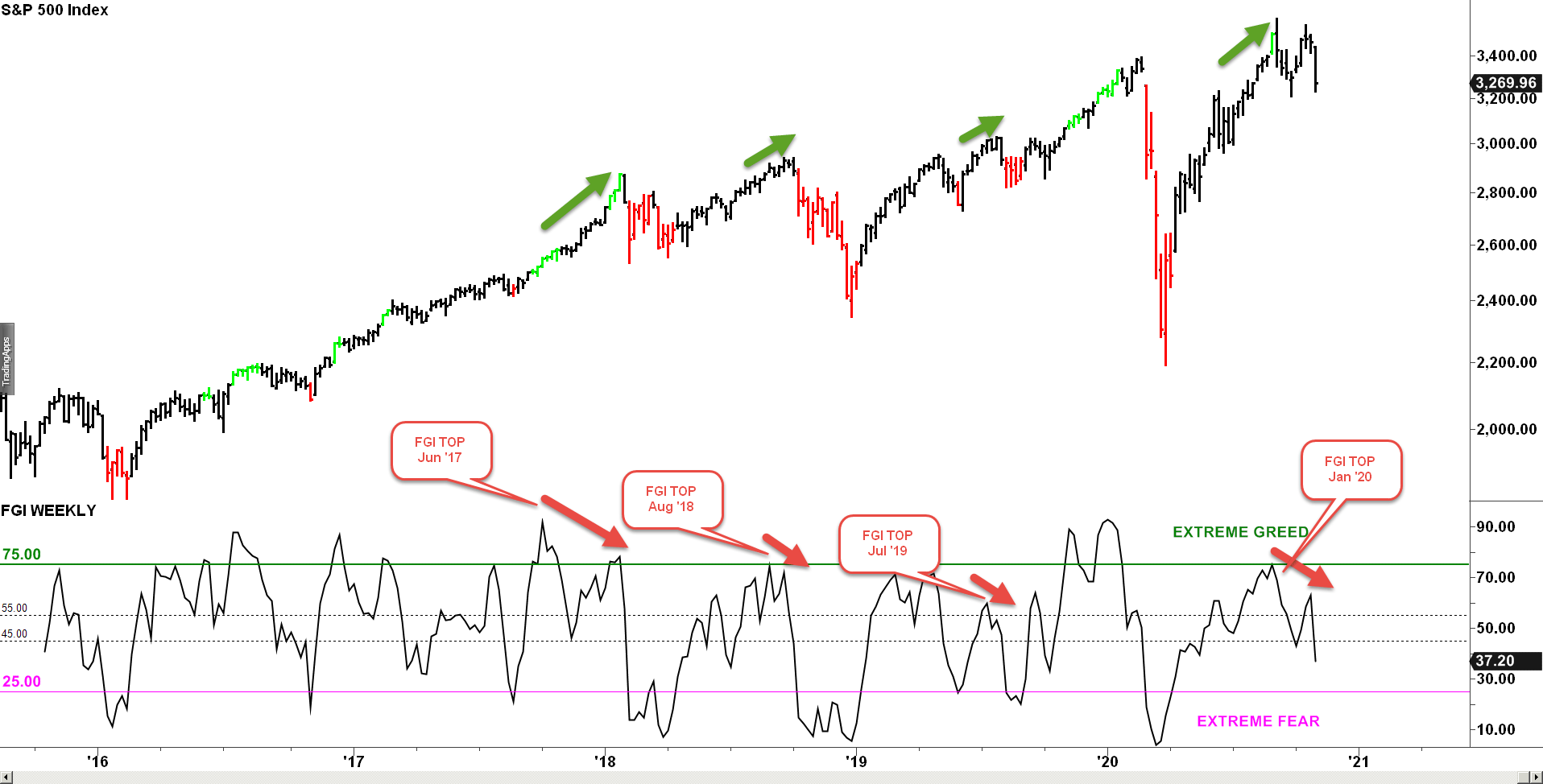

- Market Timing: The index can help investors identify potential market tops and bottoms, allowing for better timing of entry and exit points.

- Risk Management: Understanding market sentiment can aid in assessing risk levels and making informed investment choices.

- Behavioral Insights: The index provides insights into market psychology, helping investors recognize when they may be acting irrationally.

How to Use the CNN Fear and Greed Index in Investing

Investors can incorporate the CNN Fear and Greed Index into their strategies by following these steps:

- Monitor Regularly: Keep an eye on the index to understand current market sentiment.

- Combine with Other Indicators: Use the index alongside other technical and fundamental analysis tools for a comprehensive view.

- Adjust Strategies: Change investment strategies based on the index’s readings; for instance, consider more conservative investments during periods of extreme fear.

Limitations of the CNN Fear and Greed Index

While the CNN Fear and Greed Index is a valuable tool, it has its limitations:

- Lagging Indicator: The index may not always reflect real-time sentiment, as it is based on historical data.

- Oversimplification: Reducing market sentiment to a single number may overlook complex market dynamics.

- Subjectivity: The interpretation of fear and greed can vary among different investors.

Real-World Examples of the Index in Action

Understanding the practical applications of the CNN Fear and Greed Index can reinforce its value. Here are a few examples:

- Market Corrections: Historical data shows that extreme fear often precedes market recoveries, making it a potential buying opportunity.

- Investment Decisions: Investors may choose to sell during periods of extreme greed to capitalize on profits before a market correction.

Conclusion

In summary, the CNN Fear and Greed Index is an indispensable tool for investors looking to navigate the complexities of the stock market. By understanding the emotions driving market behavior, investors can make more informed decisions, manage risks effectively, and optimize their investment strategies. We encourage readers to monitor the index regularly and consider its implications when making investment choices.

We invite you to share your thoughts on the CNN Fear and Greed Index in the comments below. If you found this article helpful, please share it with others or explore more of our content for further insights into market trends.

Thank you for reading! We hope to see you back for more valuable financial insights and updates.

Also Read

Article Recommendations

ncG1vNJzZmivp6x7tMHRr6CvmZynsrS71KuanqtemLyue9KtmKtlpJ64tbvKcWacpp5is6at0WaYp5xdnL%2BmscNmoKecla17qcDMpQ%3D%3D