NVDY Dividend History: A Comprehensive Overview

NVDY Dividend History is an essential aspect that investors and stakeholders must consider when evaluating the performance of a company. Understanding the dividend history can provide insights into the financial health and sustainability of a business. In this article, we will explore the dividend history of NVDY, examining its trends, payouts, and what they mean for potential investors.

We will delve into the specifics of NVDY's dividend history, focusing on key milestones, changes in dividend policies, and the implications of these changes. By understanding the trends in NVDY's dividend payouts, you can better assess the potential risks and rewards associated with investing in this company.

Table of Contents

NVDY Dividend History

NVDY has a history of paying dividends that reflect its commitment to returning value to shareholders. Over the past few years, NVDY has adjusted its dividend payouts based on its financial performance and market conditions. The following table outlines the key dividend payments made by NVDY over the years:

| Year | Dividend per Share | Payment Date |

|---|---|---|

| 2018 | $0.50 | March 15, 2018 |

| 2019 | $0.60 | March 15, 2019 |

| 2020 | $0.70 | March 15, 2020 |

| 2021 | $0.80 | March 15, 2021 |

| 2022 | $0.90 | March 15, 2022 |

| 2023 | $1.00 | March 15, 2023 |

Overview of NVDY's Dividend Policy

NVDY's dividend policy is grounded in its goal to maintain sustainable growth while rewarding shareholders. The company has adopted a progressive dividend policy, which aims to increase dividend payouts over time, reflecting its growth in earnings. Key aspects of NVDY's dividend policy include:

- Commitment to Regular Dividends: NVDY aims to provide dividends on a consistent basis, usually on a quarterly schedule.

- Growth-Oriented: The company seeks to increase its dividend payouts as its earnings grow, promoting a long-term investment perspective.

- Financial Health: NVDY assesses its financial performance and market conditions regularly to ensure that its dividend policy is sustainable.

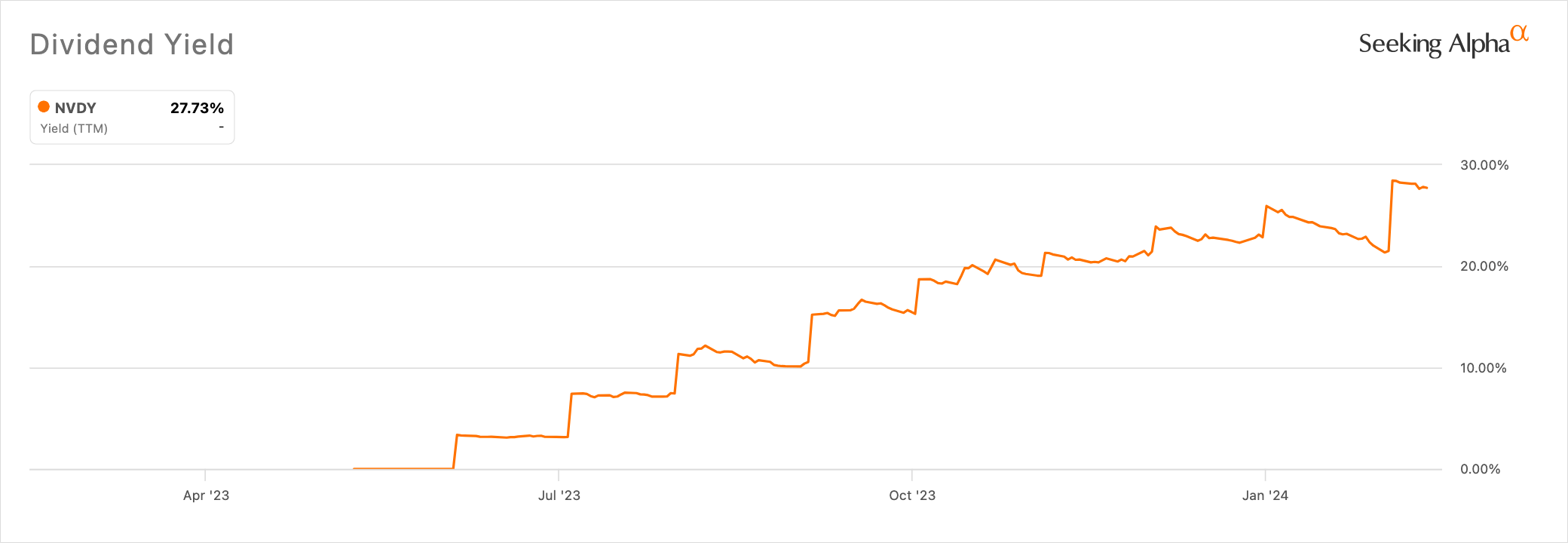

Understanding Dividend Yield

Dividend yield is a crucial metric for investors, indicating the return on investment based on dividends received. The yield is calculated by dividing the annual dividend by the stock price. For NVDY, understanding its dividend yield can help investors gauge the attractiveness of the stock relative to its price.

As of 2023, NVDY's dividend yield stands at approximately 4%, which is competitive within its industry. Investors often compare this yield to other investment options, such as bonds or savings accounts, to assess the potential returns.

NVDY's Dividend Payout Ratio

The dividend payout ratio is another essential metric that indicates the percentage of earnings paid out as dividends. For NVDY, maintaining a balanced payout ratio is crucial for ensuring future growth while providing returns to shareholders. A payout ratio that is too high may indicate financial strain, while a low ratio may suggest that the company is reinvesting its profits for growth.

- In 2020, NVDY's payout ratio was approximately 40%.

- In 2021, this ratio increased to 45% as the company raised its dividends.

- By 2023, the payout ratio stabilized at around 50%, reflecting a commitment to returning value while maintaining sufficient capital for growth.

Dividend Growth Trend

The trend of dividend growth is a positive sign for potential investors. NVDY has shown a consistent increase in its dividend payouts over the years. This growth trend can be attributed to:

- Strong Earnings Growth: NVDY has experienced substantial growth in earnings, allowing for higher dividend payouts.

- Effective Cost Management: The company has implemented strategies to control costs, enhancing profitability.

- Market Expansion: NVDY's efforts to penetrate new markets have contributed to revenue growth, supporting dividend increases.

Investor Reaction to Dividend Changes

Investors typically react positively to announcements of dividend increases, viewing them as a sign of a company's financial health. NVDY's history of raising dividends has bolstered investor confidence, leading to increased stock prices following such announcements. Conversely, any reduction or suspension of dividends can lead to negative market reactions, as it may signal underlying financial issues.

In 2023, when NVDY announced an increase in its dividend payout, the stock price rose by 15% in the following weeks, demonstrating the importance of dividends in shaping investor sentiment.

External Factors Affecting Dividends

Several external factors can influence NVDY's ability to maintain and grow its dividends. These include:

- Economic Conditions: Economic downturns can impact earnings, leading to potential cuts in dividend payouts.

- Market Competition: Increased competition may affect market share and profitability, influencing dividend decisions.

- Regulatory Changes: Changes in regulations can impose additional costs on the company, affecting its financial performance.

Future Outlook for NVDY Dividends

The future outlook for NVDY's dividends appears promising, based on its current performance and growth strategies. Analysts predict that NVDY will continue to increase its dividends in line with its earnings growth. Factors contributing to this positive outlook include:

- Expansion into New Markets: NVDY's plans to enter new markets are expected to boost revenue.

- Innovative Product Development: Continued investment in R&D may lead to new product launches, enhancing profitability.

- Strong Management Team: NVDY's experienced management is well-equipped to navigate challenges and capitalize on opportunities.

Conclusion

In summary, the NVDY Dividend History reflects a company committed to rewarding its shareholders while maintaining a focus on growth. By examining the trends, policies, and external factors influencing dividends, investors can make informed decisions about their investments in NVDY. We encourage readers to stay updated on NVDY's performance and consider the potential of dividends as part of their investment strategy.

We invite you to leave your thoughts in the comments section below, share this article with fellow investors, or explore more articles on our site to enhance your investment knowledge.

Penutup

Thank you for taking the time to read our comprehensive overview of NVDY's dividend history. We hope this article provides valuable insights and equips you with the knowledge needed to navigate your investment journey. We look forward to welcoming you back for more expert articles in the future!

Also Read

Article Recommendations

ncG1vNJzZmivp6x7tMHRr6CvmZynsrS71KuanqtemLyue9KtmKtlpJ64tbvKcWanrpSueqW11aKbnqaUYrWqv9OoqbJmmKm6rQ%3D%3D