Revolutionizing Payment Solutions For The Modern Consumer

The Kittrell Paycard is transforming the way consumers manage their finances and make transactions in today's fast-paced digital world. With its innovative features and user-friendly interface, this payment solution is gaining traction among consumers looking for a reliable and efficient way to handle their money. In this article, we will explore the intricacies of the Kittrell Paycard, its benefits, and how it stands out in the crowded financial technology landscape.

As financial technology continues to evolve, products like the Kittrell Paycard are at the forefront of this revolution. This card not only simplifies payments but also offers enhanced security features and rewards programs that appeal to a broad audience. In the following sections, we will delve deeper into the functionality of the Kittrell Paycard, its unique selling propositions, and what potential users need to know before signing up.

Whether you are an individual seeking a convenient payment method or a business exploring options to improve financial transactions, understanding the Kittrell Paycard is essential. Join us as we break down this innovative payment solution and uncover why it's becoming a go-to choice for many consumers today.

Table of Contents

What is Kittrell Paycard?

The Kittrell Paycard is a prepaid debit card that allows users to make purchases, pay bills, and manage their finances without the need for a traditional bank account. It is designed to provide a simple and effective way to handle everyday transactions while offering users control over their spending.

This card can be used anywhere that accepts major credit cards, making it a versatile payment solution. Additionally, Kittrell Paycard is ideal for individuals who may not have access to banking services or those looking to manage their finances more effectively.

Data Personal and Biodata

| Feature | Description |

|---|---|

| Card Type | Prepaid Debit Card |

| Issuer | Kittrell Financial Services |

| Usage | In-store and online purchases |

| Fees | Monthly maintenance fees, transaction fees |

| Reload Options | Direct deposit, cash reload at participating locations |

Key Features of Kittrell Paycard

The Kittrell Paycard is equipped with several key features that set it apart from other payment solutions. These features are designed to enhance user experience and provide added value to cardholders.

- Instant Access to Funds: Users can load money onto their cards instantly, allowing for immediate access to funds.

- Budgeting Tools: The card comes with integrated budgeting tools that help users track their spending and manage their finances effectively.

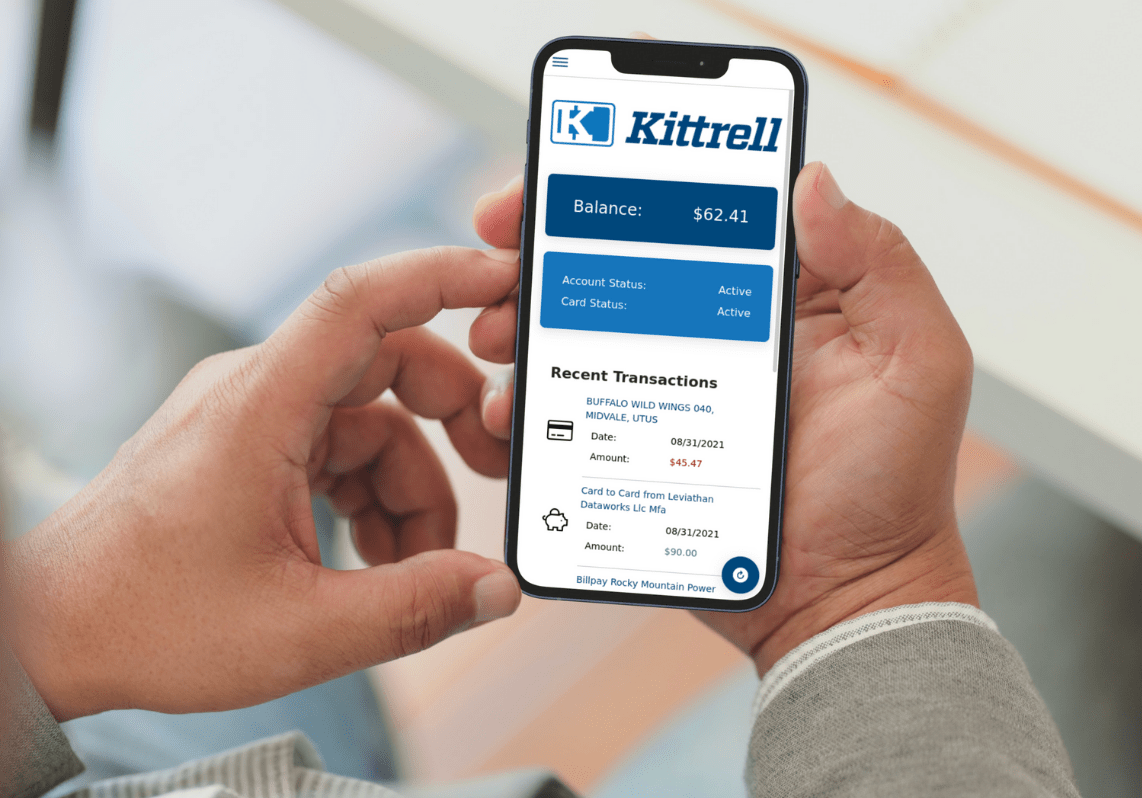

- Mobile App: The Kittrell Paycard has a dedicated mobile app that allows users to check their balance, view transaction history, and manage card settings on the go.

- Rewards Program: Cardholders can earn rewards on purchases, providing an incentive to use the card for everyday transactions.

Benefits of Using Kittrell Paycard

Using the Kittrell Paycard comes with a range of benefits that appeal to various consumer needs. Here are some of the notable advantages:

- Financial Independence: The Kittrell Paycard allows users to manage their finances without a bank account, promoting financial independence.

- Enhanced Security: With advanced security features, users can feel confident that their funds are protected against fraud.

- Control Over Spending: The prepaid nature of the card limits spending to the available balance, reducing the risk of overspending and debt.

- Convenience: The ability to make purchases online and in stores makes the Kittrell Paycard a convenient option for daily transactions.

How to Get Started with Kittrell Paycard

Getting started with the Kittrell Paycard is a straightforward process. Here’s how you can sign up:

Security Features of Kittrell Paycard

Security is a top priority for Kittrell Paycard users. The card is equipped with several security features, including:

- Two-Factor Authentication: Users must verify their identity through a second method, enhancing security during transactions.

- Transaction Alerts: Users receive real-time alerts for transactions, allowing them to monitor their account activity.

- Fraud Protection: The Kittrell Paycard offers protection against unauthorized transactions, providing peace of mind to users.

Comparison with Competitors

When comparing the Kittrell Paycard to other similar products on the market, it stands out due to its unique combination of features and user-friendly interface. Here’s a brief comparison:

| Feature | Kittrell Paycard | Competitor A | Competitor B |

|---|---|---|---|

| Instant Fund Access | Yes | No | Yes |

| Mobile App | Yes | Basic | Yes |

| Rewards Program | Yes | No | Limited |

| Budgeting Tools | Yes | No | No |

Real-World Use Cases of Kittrell Paycard

The Kittrell Paycard has been successfully utilized in various real-world scenarios. Here are some examples:

- Travel: Travelers can use the Kittrell Paycard to manage expenses while abroad, avoiding high foreign transaction fees.

- Online Shopping: The card is ideal for making secure online purchases without exposing bank account information.

- Budgeting for Events: Users can load a specific amount onto the card for events, ensuring they stay within their budget.

Customer Testimonials

Customers have expressed their positive experiences with the Kittrell Paycard. Here are a few testimonials:

"The Kittrell Paycard has made managing my expenses so much easier. I love the budgeting tools!" - Sarah J.

"I travel a lot for work, and this card has saved me on international fees. Highly recommend it!" - Mike T.

Conclusion

In conclusion, the Kittrell Paycard offers a comprehensive solution for consumers looking to manage their finances effectively. With its array of features, benefits, and security measures, it stands out as a reliable option in today's financial landscape. If you're ready to take control of your

Also Read

Article Recommendations

ncG1vNJzZmivp6x7tMHRr6CvmZynsrS71KuanqtemLyue9WiqZqko6q9pr7SrZirq2dkuKrA06ucpaRdpa66r8Crm2egpKK5