Riverside County CA Tax Assessor: Understanding Property Tax Assessment

Riverside County CA Tax Assessor plays a crucial role in determining property values and ensuring fair taxation for residents. Understanding how the tax assessor operates can significantly impact property owners and potential buyers in the area. This article will explore the functions of the Riverside County Tax Assessor's office, the assessment process, and how property taxes are calculated.

The Riverside County Tax Assessor is responsible for appraising properties, maintaining property records, and ensuring compliance with state tax laws. With a diverse range of properties, from residential homes to commercial buildings, the assessor's office plays a vital role in the financial stability of the county. This article aims to provide comprehensive information about the tax assessor's role in Riverside County and what residents need to know about their property taxes.

In the following sections, we will delve deeper into the assessment process, the importance of accurate property valuations, and the resources available for residents to understand their property taxes better. Whether you are a current homeowner, a potential buyer, or simply interested in local governance, this article will equip you with valuable insights into Riverside County's tax assessment system.

Table of Contents

Overview of the Riverside County Tax Assessor

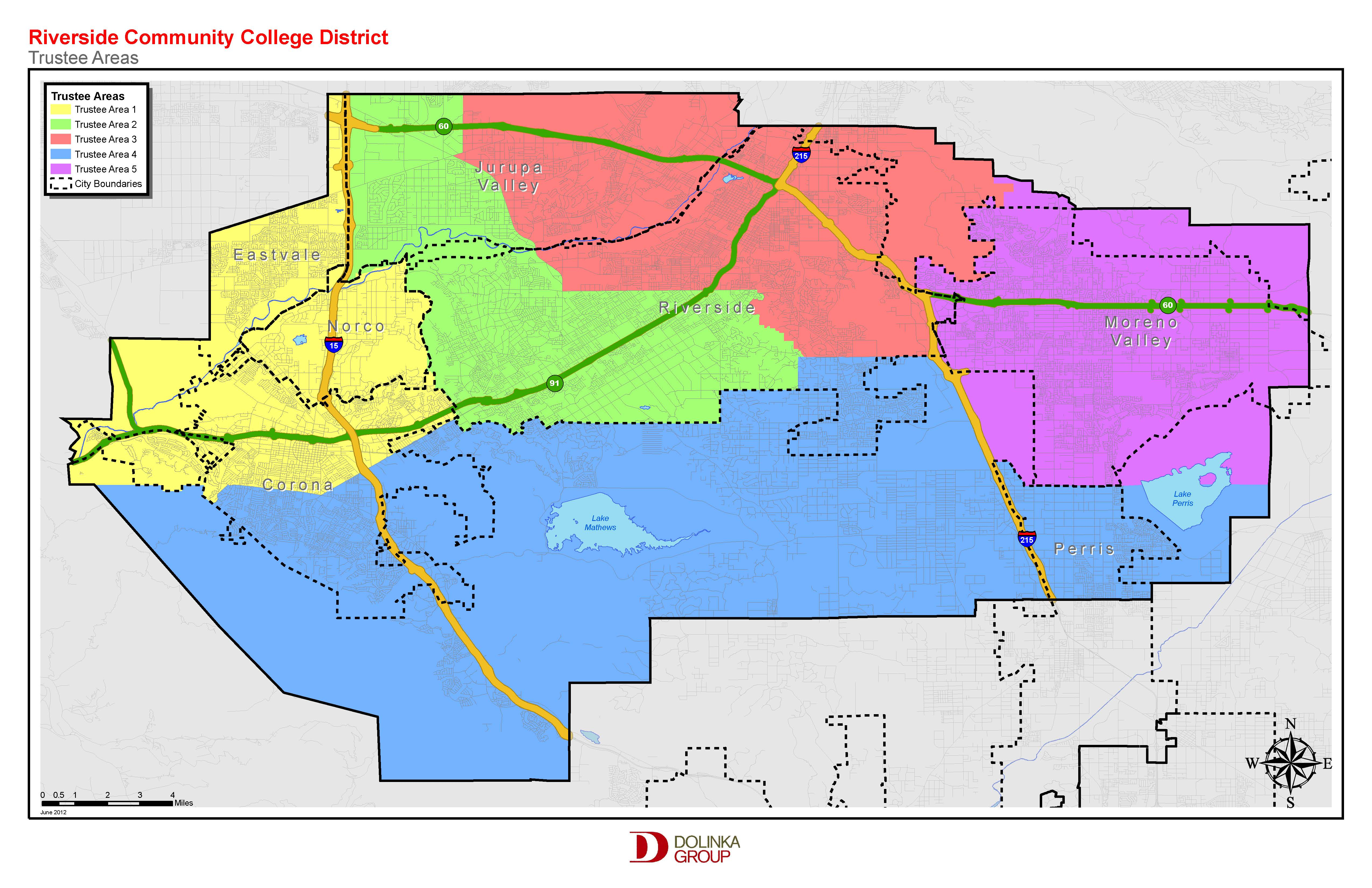

The Riverside County Tax Assessor's office is tasked with the essential duty of assessing the value of all taxable properties within the county. This includes residential, commercial, and industrial properties. The assessments conducted by the office are crucial for determining the amount of property tax that homeowners and businesses will owe each year.

In Riverside County, the property tax assessment is based on the fair market value of the property as of January 1st of each year. This value is determined through various methods, including sales comparisons, income approaches, and cost methods. The tax assessor must adhere to California state laws and regulations to ensure that assessments are conducted fairly and uniformly.

Biography of the Current Tax Assessor

The current Riverside County Tax Assessor is [Name], who has been in office since [Year]. [Name] has an extensive background in property valuation and tax law, having previously worked in various roles within the county government.

| Detail | Information |

|---|---|

| Name | [Name] |

| Position | Tax Assessor |

| Years in Office | [Years] |

| Education | [Degree] |

| Previous Positions | [List Previous Roles] |

Understanding the Property Assessment Process

The property assessment process in Riverside County involves several key steps:

- Property Data Collection: The assessor's office gathers data on each property, including size, location, and improvements.

- Market Analysis: The office analyzes the real estate market to determine the fair market value of properties.

- Property Valuation: Using the collected data and market analysis, the assessor assigns a value to each property.

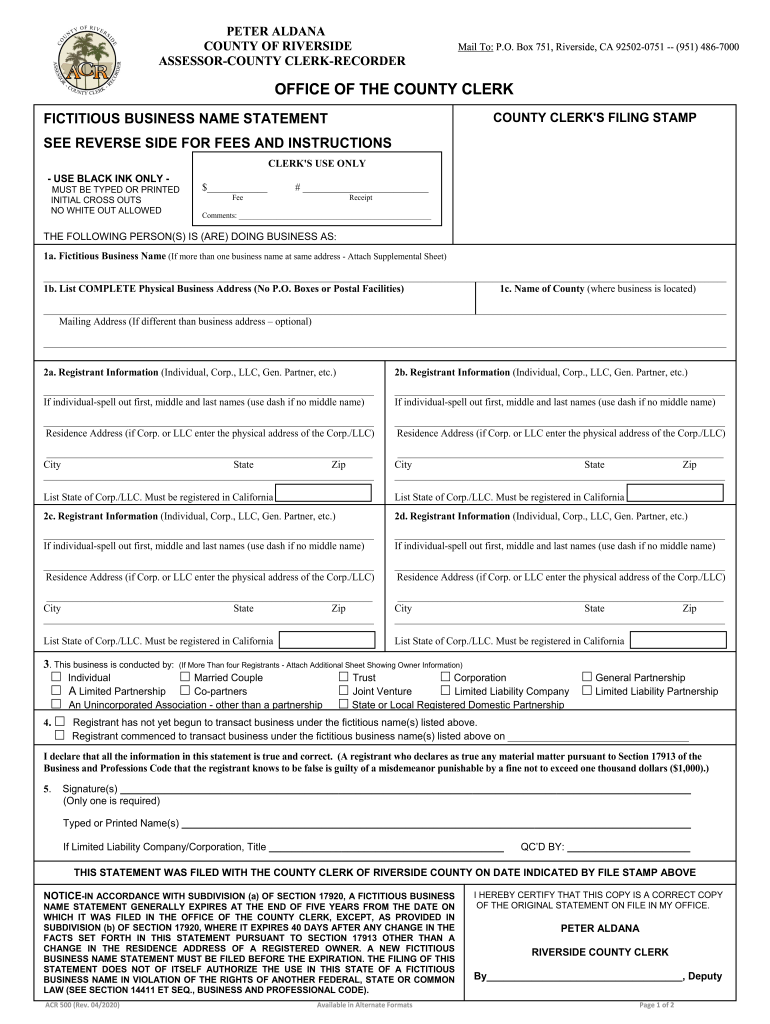

- Notification: Property owners are notified of their assessments, and they have the right to appeal if they believe the value is incorrect.

Factors Affecting Property Valuation

Several factors can influence property valuation in Riverside County, including:

- Location: Properties in desirable neighborhoods often have higher values.

- Condition: Well-maintained properties typically appraise at higher values than those needing repairs.

- Market Trends: Changes in the real estate market can affect property values.

- Improvements: Any upgrades or additions to a property can increase its assessed value.

How Property Taxes Are Calculated

The property tax calculation in Riverside County involves the following steps:

The average property tax rate in Riverside County is [insert current rate] percent, but this can vary by district. Understanding how these calculations work can help property owners budget for their tax obligations.

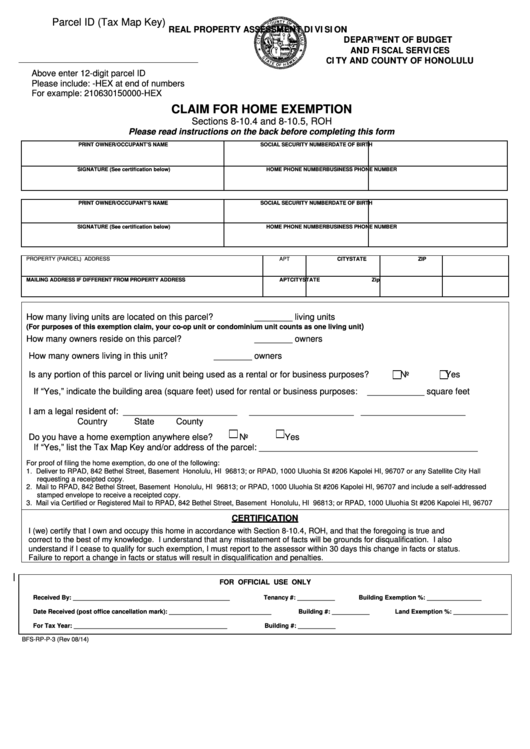

Available Property Tax Exemptions

Riverside County offers several property tax exemptions that can help reduce the tax burden for eligible homeowners, including:

- Homeowners' Exemption: Provides a reduction in the taxable value of a primary residence.

- Disabled Veteran's Exemption: Available for veterans with service-related disabilities.

- Senior Citizen Exemption: Offers tax relief for senior citizens under certain income thresholds.

Resources for Property Owners

Property owners in Riverside County can access various resources to help them understand and manage their property taxes:

- Riverside County Tax Assessor Website: Provides information on property assessments, tax rates, and exemptions.

- Property Tax Payment Portal: Allows residents to pay their property taxes online.

- Appeal Process Information: Outlines the steps for contesting an assessment.

Conclusion

In summary, the Riverside County CA Tax Assessor plays a vital role in determining property values and assessing property taxes. Understanding the assessment process, factors affecting valuation, and available exemptions can empower property owners to make informed decisions about their real estate investments. We encourage you to explore the resources available and stay informed about your property tax obligations.

If you have any questions or comments about the Riverside County Tax Assessor's office or property taxes, please leave your thoughts below. Your feedback is valuable, and we invite you to share this article with others who may benefit from understanding the property tax system in Riverside County.

Thank you for reading, and we look forward to welcoming you back for more insightful articles in the future!

Also Read

Article Recommendations

ncG1vNJzZmivp6x7tMHRr6CvmZynsrS71KuanqtemLyue8SnraKqn6O6prrTmqNvZ6Kew6a%2B0qKbnmWTpMKvwNhmmpplpJbFbq3SrJysq5%2Bne6nAzKU%3D