Understanding Credit Hero Score: A Comprehensive Guide

Credit Hero Score is an essential aspect of your financial health, influencing everything from loan approvals to interest rates. In today’s financial landscape, understanding your credit score is more crucial than ever. This guide delves deep into what Credit Hero Score is, how it works, and why it matters to you. Whether you’re looking to improve your credit score or simply gain a better understanding of it, this article will provide you with valuable insights and practical advice.

The Credit Hero Score is not just a number; it is a reflection of your creditworthiness and financial behavior. It is used by lenders to assess the risk of lending money to you. A higher score can lead to better loan terms, while a lower score may result in higher interest rates or even loan denial. Therefore, knowing how to manage and improve your Credit Hero Score can significantly impact your financial future.

In this comprehensive article, we will explore the various components that make up the Credit Hero Score, tips for improving it, common myths surrounding credit scores, and resources for monitoring your credit. By the end of this guide, you’ll be equipped with the knowledge to take control of your credit health and make informed financial decisions.

Table of Contents

What is Credit Hero Score?

The Credit Hero Score is a numerical expression of your creditworthiness, typically ranging from 300 to 850, with higher scores indicating lower risk to lenders. This score is derived from various factors related to your credit history, such as payment history, credit utilization, length of credit history, types of credit accounts, and recent inquiries.

Components of Credit Hero Score

Understanding what contributes to your Credit Hero Score is vital for managing it effectively. Here are the primary components:

- Payment History (35%): Your track record of on-time payments significantly affects your score. Late payments, defaults, and bankruptcies can have a negative impact.

- Credit Utilization (30%): The ratio of your current credit card balances to your credit limits. Keeping this ratio below 30% is generally recommended.

- Length of Credit History (15%): A longer credit history can positively affect your score, as it provides lenders with more data about your credit behavior.

- Types of Credit (10%): A mix of different types of credit accounts, such as credit cards, mortgages, and installment loans, can enhance your score.

- Recent Inquiries (10%): Multiple hard inquiries within a short period can lower your score, indicating a potential risk to lenders.

Understanding the Breakdown of Your Score

Each component plays a crucial role in determining your Credit Hero Score. By focusing on these aspects, you can strategize effectively to improve your score.

How to Improve Your Credit Hero Score

Improving your Credit Hero Score is achievable with consistent effort and smart financial practices. Here are some effective strategies:

- Pay Your Bills on Time: Set reminders or automate payments to avoid late fees.

- Reduce Your Credit Card Balances: Aim for a credit utilization ratio below 30%.

- Keep Old Accounts Open: Closing old credit accounts can shorten your credit history.

- Diversify Your Credit: Consider adding different types of credit to your profile, such as installment loans.

- Limit Hard Inquiries: Avoid applying for multiple credit accounts in a short period.

Common Myths About Credit Scores

There are many misconceptions about credit scores that can lead to poor financial decisions. Here are some common myths:

- Checking Your Own Score Hurts It: This is false. Checking your own credit score is considered a soft inquiry and does not affect your score.

- Closing Old Accounts Improves Your Score: This can actually hurt your score by shortening your credit history.

- All Credit Scores Are the Same: Different scoring models may yield different scores.

- Credit Repair Companies Can Fix Your Score Overnight: There are no quick fixes for improving your credit score.

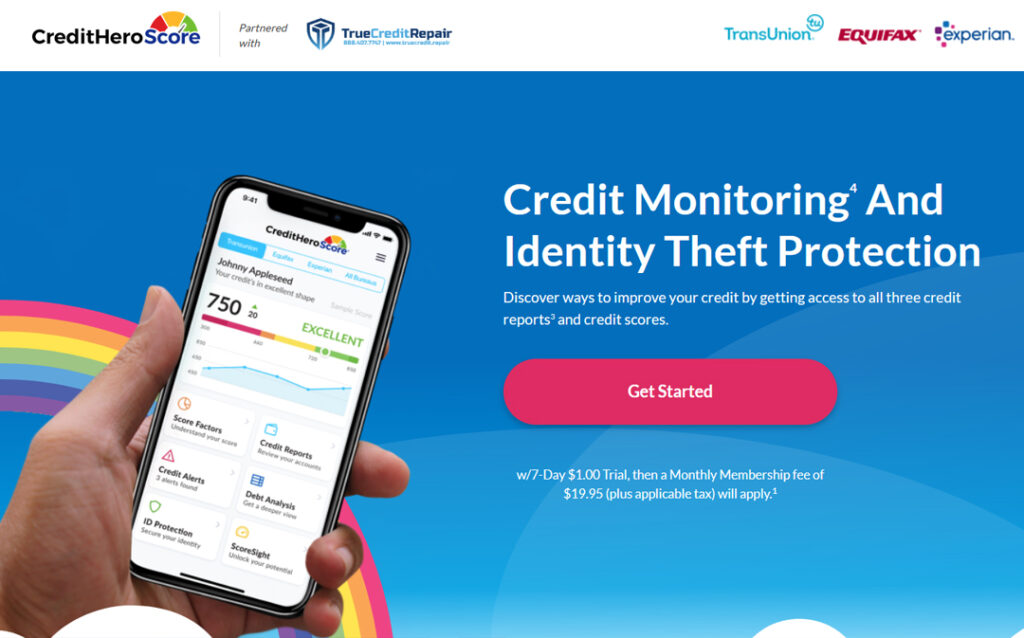

Monitoring Your Credit Hero Score

Regularly monitoring your Credit Hero Score is essential for maintaining good credit health. Here are some methods to track your score:

- Free Credit Report Services: Utilize services that offer free credit reports and scores.

- Credit Monitoring Services: Consider signing up for a credit monitoring service that alerts you to changes in your score.

- Annual Credit Report: Request a free copy of your credit report from the three major credit bureaus once a year.

Impact of Credit Hero Score on Finances

Your Credit Hero Score has a profound impact on various aspects of your financial life, including:

- Loan Approvals: A higher score increases your chances of loan approval.

- Interest Rates: Better scores often lead to lower interest rates on loans and credit cards.

- Renting and Employment: Some landlords and employers check credit scores as part of their application process.

When to Check Your Credit Hero Score

It’s advisable to check your Credit Hero Score regularly, especially before making significant financial decisions such as applying for a mortgage or car loan. Additionally, monitor your score if:

- You receive a notice of a credit inquiry.

- You suspect fraud or identity theft.

- You want to track your progress after implementing improvement strategies.

Conclusion

Understanding your Credit Hero Score is crucial for achieving your financial goals. By being proactive in managing your credit, you can improve your score and secure better financial opportunities. We encourage you to take action today—start monitoring your score, address any issues, and implement the strategies discussed in this article. If you found this information helpful, feel free to leave a comment or share this article with others who may benefit from it.

Thank you for reading, and we hope to see you back on our site for more insightful articles on financial health and well-being!

Also Read

Article Recommendations

ncG1vNJzZmivp6x7tMHRr6CvmZynsrS71KuanqtemLyue8GlpqeclaOyuL%2BQb2acqpWZtrW0xKumrJufp7JvtNOmow%3D%3D