Understanding JEPQ Dividend: A Comprehensive Guide

In the world of investments, understanding the dynamics of dividends is crucial for making informed decisions. One such investment opportunity that has gained attention is the JEPQ dividend. This article delves deep into what JEPQ is, its dividend structure, and how it can benefit investors. Whether you are a seasoned investor or just starting your journey, this guide will provide valuable insights into JEPQ dividends.

The JEPQ, or the JPMorgan Equity Premium Income ETF, is a fund designed to provide investors with a steady stream of income through dividends, while also offering exposure to equity markets. The fund employs a unique strategy that combines equity investments with options trading to enhance returns. Understanding how JEPQ operates and the dividends it offers can help you determine if this investment aligns with your financial goals.

In this article, we will explore various aspects of JEPQ dividends, including its underlying structure, performance metrics, and comparisons with other dividend-paying investments. We aim to equip you with the knowledge needed to assess the potential of JEPQ as a viable investment option.

Table of Contents

What is JEPQ?

The JPMorgan Equity Premium Income ETF (JEPQ) is an exchange-traded fund that aims to provide investors with both capital appreciation and income through dividends. The fund primarily invests in U.S. large-cap equities while employing an options strategy to generate additional income. This unique approach allows JEPQ to offer an attractive dividend yield, making it a popular choice among income-focused investors.

Data and Personal Information

| Fund Name | JPMorgan Equity Premium Income ETF |

|---|---|

| Ticker Symbol | JEPQ |

| Inception Date | May 20, 2022 |

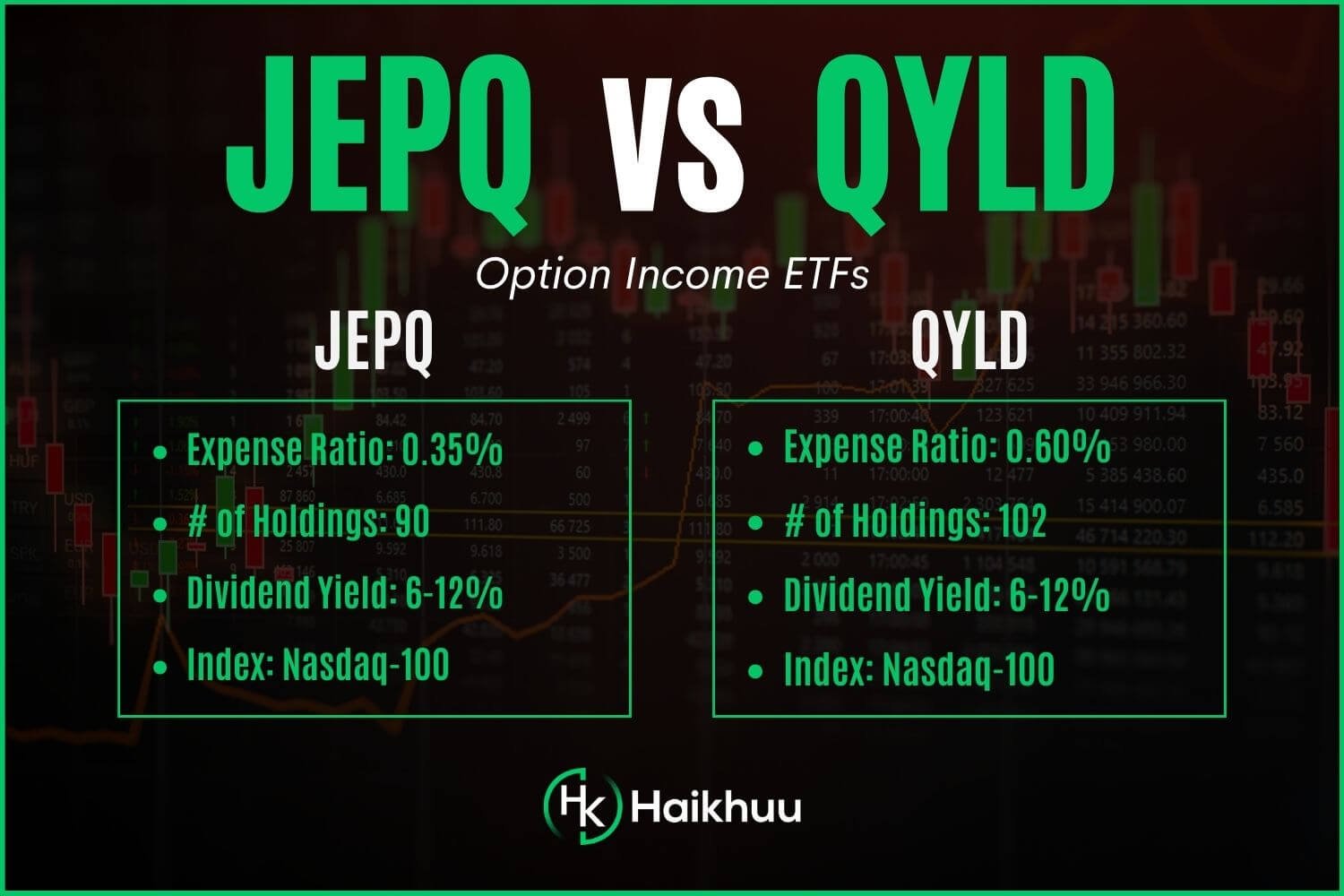

| Expense Ratio | 0.35% |

| Dividend Yield | Approximately 7% (as of 2023) |

| Fund Manager | JPMorgan Asset Management |

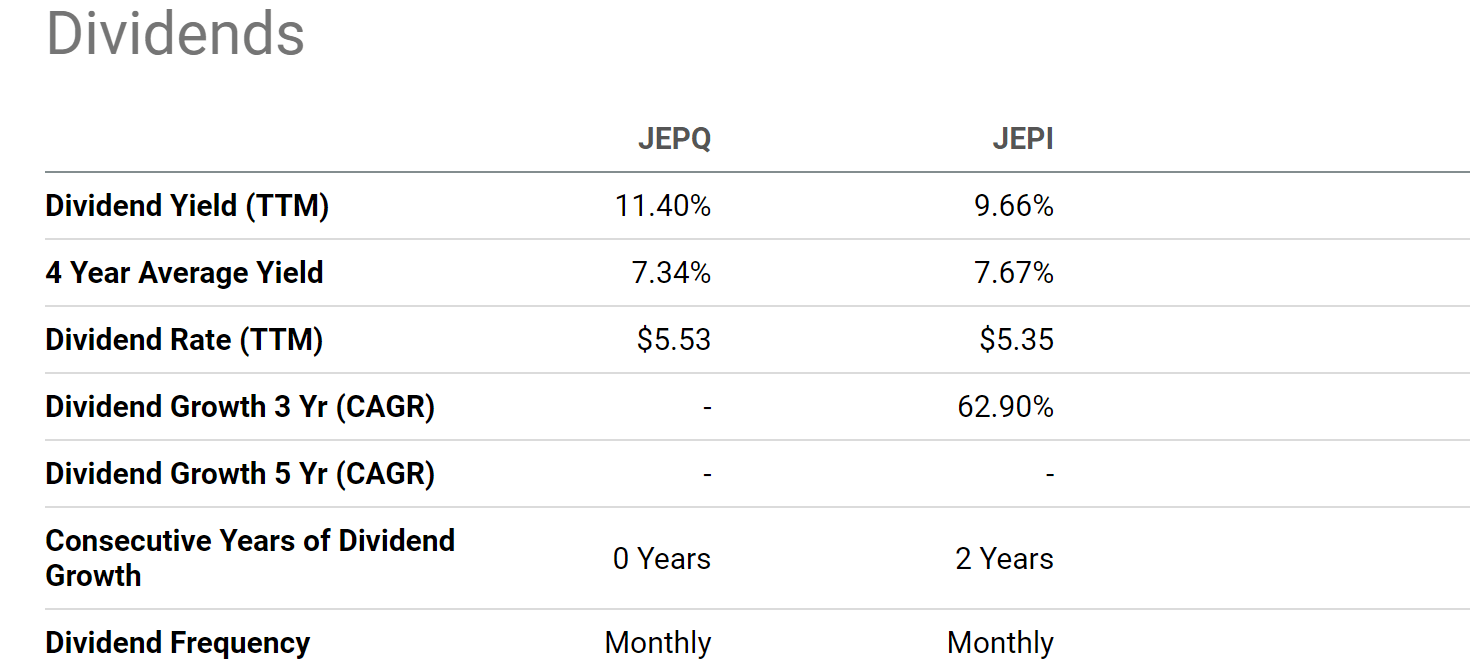

JEPQ Dividend Structure

The dividend structure of JEPQ is designed to provide regular income to its shareholders. The fund typically pays dividends on a monthly basis, which can be a significant advantage for investors seeking consistent cash flow. The dividends are derived from the income generated by the underlying equities and the options strategies employed by the fund.

How Dividends are Calculated

Dividends are calculated based on the fund's earnings from its investments. Key factors influencing the dividend distribution include:

- Performance of the underlying equities

- Income generated from options premiums

- Overall market conditions

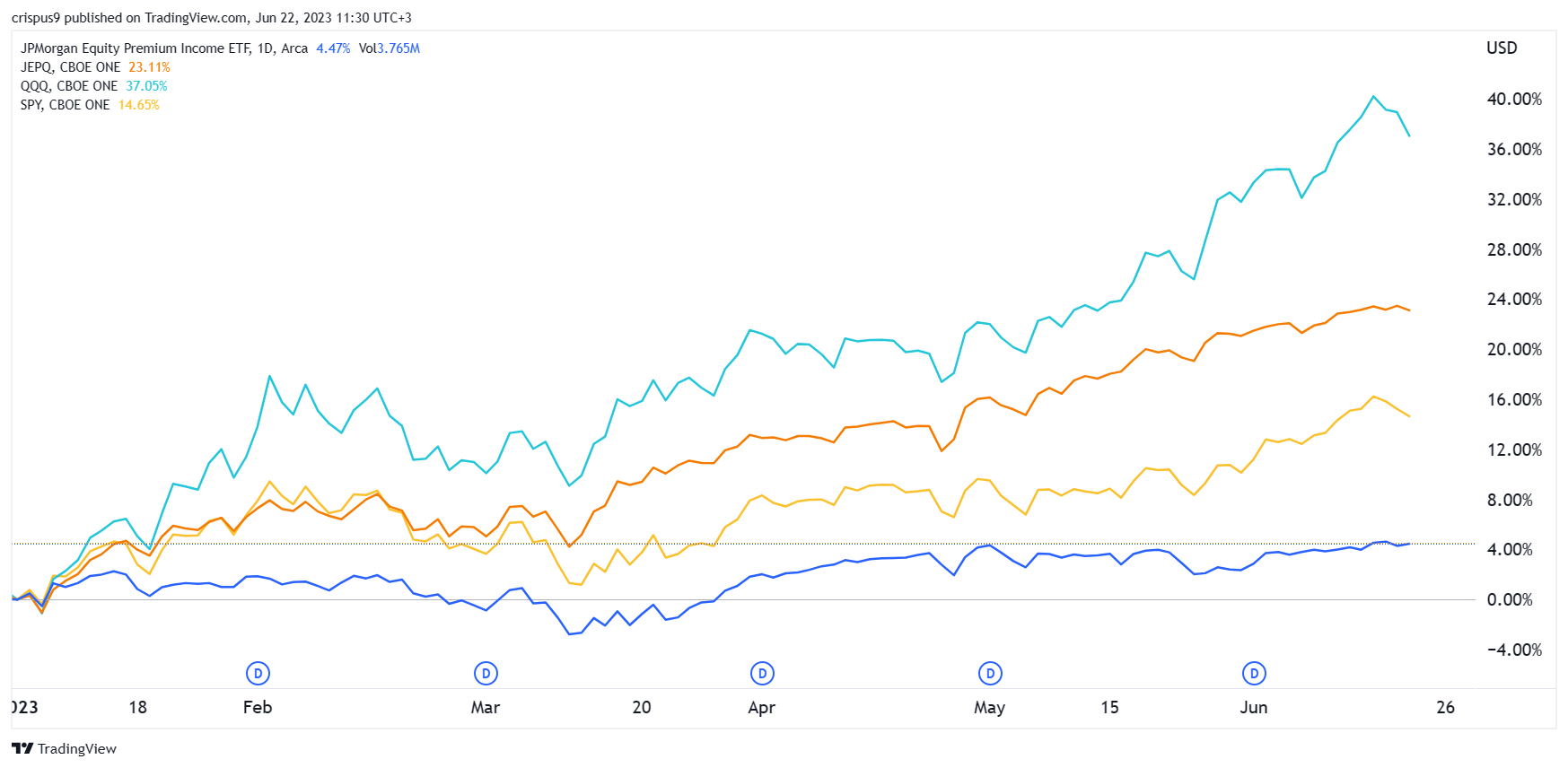

Performance of JEPQ

Understanding the historical performance of JEPQ is critical for evaluating its potential as an investment. Since its inception, JEPQ has demonstrated impressive results, driven by a combination of capital gains and dividend income.

Performance Metrics

Some key performance metrics to consider include:

- Annualized return since inception

- Dividend growth rate

- Volatility compared to benchmark indices

Comparing JEPQ Dividends with Other Investments

When considering JEPQ as an investment option, it is essential to compare its dividends with other similar instruments. This can provide context and help you make informed decisions.

Comparison with Traditional Dividend Stocks

Unlike traditional dividend-paying stocks, JEPQ offers a more diversified approach by combining equity exposure with options trading. This can result in higher yields, but it also involves different risk factors.

Tax Implications of JEPQ Dividends

Investors should also consider the tax implications of JEPQ dividends. Generally, dividends are subject to taxation, and understanding how they fit into your overall tax strategy is essential.

Tax Treatment of Dividends

Dividends from JEPQ may be taxed as qualified dividends, which typically have a lower tax rate compared to ordinary income. However, the exact tax treatment can vary based on individual circumstances and current tax laws.

Investing in JEPQ: Key Considerations

Before investing in JEPQ, it is important to evaluate several key considerations:

- Your investment goals and risk tolerance

- The fund's expense ratio and management fees

- Market conditions and economic outlook

Risk Factors Associated with JEPQ

Like all investments, JEPQ comes with its own set of risks. Understanding these risks can help mitigate potential downsides.

Market and Credit Risks

Investors should be aware of market fluctuations that can affect the value of the fund's holdings. Additionally, credit risks associated with the underlying equities may impact dividend payments.

Conclusion

In summary, the JEPQ dividend presents an appealing option for investors seeking both income and growth potential. With its unique structure and attractive yield, JEPQ can fit well into a diversified investment portfolio. As always, it is essential to conduct thorough research and consider your financial goals before investing.

We encourage you to share your thoughts on JEPQ dividends in the comments below. If you found this article informative, please consider sharing it with others or exploring more articles on our site.

Thank you for reading, and we look forward to providing you with more valuable insights in the future!

Also Read

Article Recommendations

ncG1vNJzZmivp6x7tMHRr6CvmZynsrS71KuanqtemLyue9KtmKtlpJ64tbvKcGajnaCmeqW11aKbnqaUY7W1ucs%3D