Understanding Ltd Commodities: A Comprehensive Guide

In the world of trading and investment, the term "Ltd commodities" refers to a specific category of physical goods that are traded in markets, particularly in the context of limited availability or restricted supply. This article will delve into the nuances of Ltd commodities, exploring their significance in the market, investment opportunities, and the intricacies of trading them. As we navigate through the complexities of Ltd commodities, it is essential to grasp the underlying principles and how they can impact both individual investors and larger economic systems.

The significance of Ltd commodities extends beyond mere investment; they play a crucial role in various industries, influencing prices and availability of essential goods. Understanding the dynamics of these commodities is vital for anyone looking to invest wisely or engage in trading practices that can yield profitable returns. Through this article, we aim to provide a thorough analysis of Ltd commodities, including market trends, risks, and strategies for success.

Moreover, we will highlight the importance of expertise, authority, and trustworthiness in the realm of commodities trading. By adhering to the principles of E-E-A-T (Expertise, Authoritativeness, Trustworthiness), we ensure that the information presented is not only informative but also reliable and valuable for readers seeking to enhance their knowledge in this field.

Table of Contents

What Are Ltd Commodities?

Ltd commodities, or limited commodities, are physical goods that are characterized by their restricted availability in the market. These commodities are often subject to fluctuations in supply and demand, making them unique in the trading landscape. Examples of Ltd commodities include rare metals, specialized agricultural products, and certain energy resources.

Characteristics of Ltd Commodities

- Scarcity: Ltd commodities are often produced in limited quantities, making them rare and sought after.

- Market Sensitivity: Prices of Ltd commodities can be highly volatile, influenced by market trends and global economic conditions.

- Investment Potential: Due to their limited supply, these commodities can offer significant returns for investors who can navigate the market effectively.

Importance of Ltd Commodities

The importance of Ltd commodities in the global economy cannot be overstated. They serve as essential resources for various industries, including manufacturing, energy production, and agriculture. Understanding their significance helps investors appreciate their value in market dynamics.

Economic Impact

Ltd commodities can greatly influence economic stability and growth. For instance, fluctuations in the price of rare metals can affect manufacturing costs, while changes in agricultural commodity prices can impact food supply chains.

Types of Ltd Commodities

There are various types of Ltd commodities, each with its unique characteristics and market applications. Understanding these types can aid investors in making informed decisions.

1. Precious Metals

Precious metals like gold, silver, and platinum are prime examples of Ltd commodities. Their scarcity and inherent value make them a popular choice for investors.

2. Rare Earth Elements

Rare earth elements are crucial in technology manufacturing and renewable energy solutions. Their limited supply combined with high demand makes them valuable commodities.

Investing in Ltd Commodities

Investing in Ltd commodities requires a strategic approach. Here are some key factors to consider:

- Research: Conduct thorough research to understand market trends and demand for specific commodities.

- Diversification: Diversify your portfolio to mitigate risks associated with price volatility.

- Market Timing: Pay attention to market cycles and timing when entering or exiting positions.

Risks Associated with Ltd Commodities

Like any investment, trading in Ltd commodities comes with its own set of risks. Recognizing these risks is essential for successful trading.

Market Volatility

The prices of Ltd commodities can fluctuate wildly due to various factors, including geopolitical events, economic changes, and supply chain disruptions.

Regulatory Risks

Changes in regulations can impact the production and trading of Ltd commodities, making it crucial for investors to stay informed about legal developments.

Trading Strategies for Ltd Commodities

Implementing effective trading strategies can enhance your success in the Ltd commodities market. Here are a few strategies to consider:

- Technical Analysis: Use charts and indicators to identify trading opportunities based on historical price movements.

- Fundamental Analysis: Analyze economic data and market reports to gauge the potential for price changes.

- Hedging: Consider hedging your investments to protect against potential losses.

Market Trends and Analysis

Staying updated on market trends is vital for anyone involved in Ltd commodities trading. Key trends to monitor include:

Global Demand Shifts

Changes in global demand for certain commodities can significantly impact prices. For instance, the rise of electric vehicles has increased demand for lithium, a key component in batteries.

Technological Advancements

Technological innovations can affect the production and efficiency of commodity extraction, influencing supply dynamics.

Future of Ltd Commodities

The future of Ltd commodities looks promising, with continued demand expected in various sectors. As industries evolve, the importance of these commodities will likely grow, presenting new opportunities for investors.

Sustainability Trends

With a global shift towards sustainability, commodities that support green initiatives, such as renewable energy resources, may see increased interest and investment.

Conclusion

In conclusion, Ltd commodities offer unique investment opportunities and challenges. Understanding their characteristics, market dynamics, and associated risks is crucial for successful trading. As you consider entering the world of Ltd commodities, remember to conduct thorough research and stay informed about market trends.

We invite you to share your thoughts on this article in the comments section below. If you found this information valuable, consider sharing it with others or exploring more articles on our site to deepen your understanding of commodities trading.

Penutup

Thank you for reading our comprehensive guide on Ltd commodities. We hope this article has equipped you with the knowledge needed to navigate the complexities of this fascinating market. We look forward to seeing you back on our site for more insightful content!

Also Read

Article Recommendations

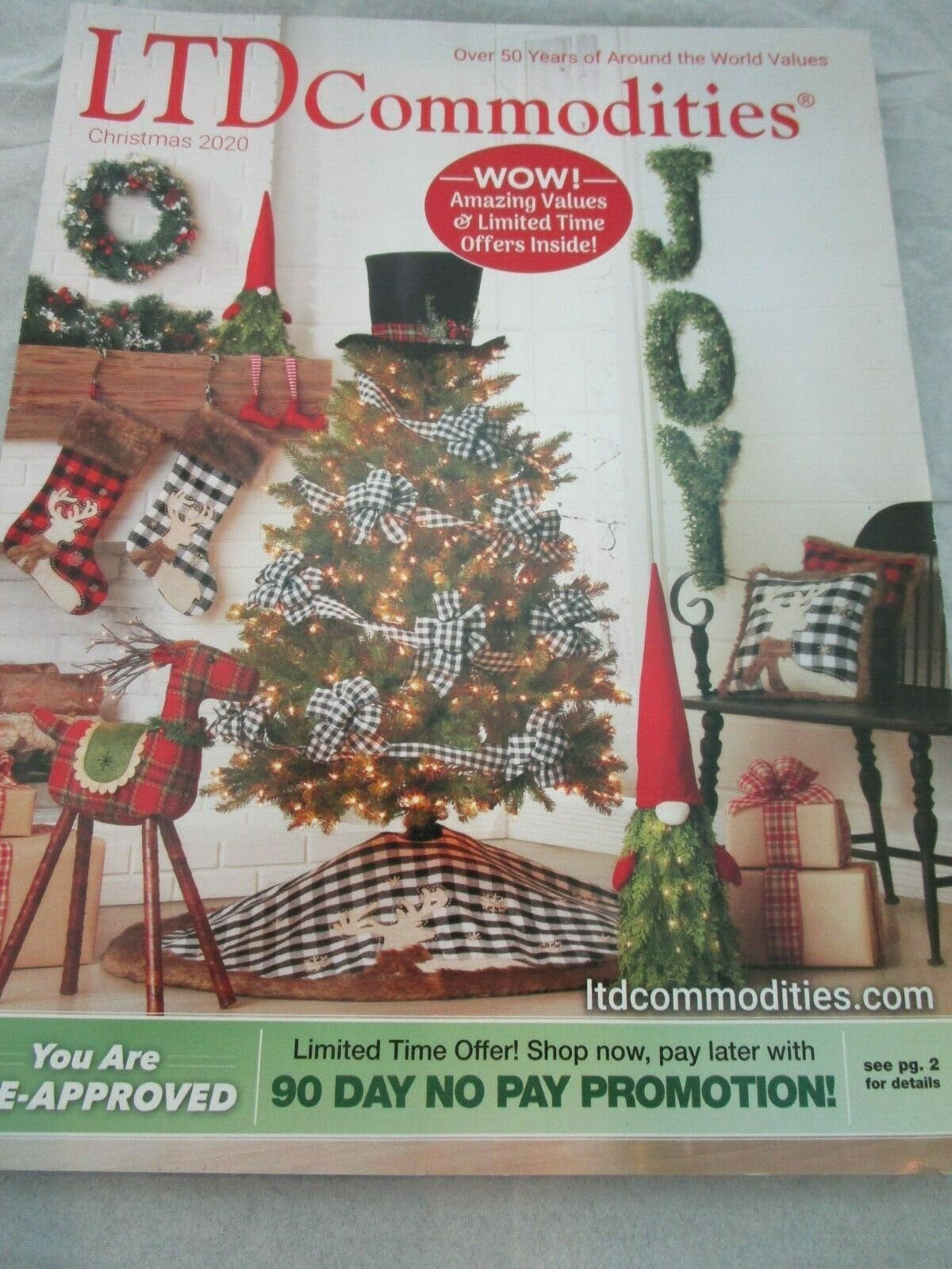

:max_bytes(150000):strip_icc()/ltd-catalog-589b541a5f9b58819c60afda.jpg)

:max_bytes(150000):strip_icc()/ltd-signup-catalog-384c9ee2d65b4738ba8cffd3f89515bf.jpg)

ncG1vNJzZmivp6x7tMHRr6CvmZynsrS71KuanqtemLyue9Oop6edp6iEcLjTnWScp52ivKW106KcrGaYqbqt