Understanding MyInflow Current And Available Balance: A Comprehensive Guide

In today's digital banking era, understanding your financial status is crucial, and one of the key components of this is knowing your MyInflow current and available balance. Many users often find themselves confused between these two terms, which can lead to mismanagement of funds. This article aims to clarify these concepts, providing you with a deeper understanding of how to manage your finances effectively.

As we delve into the details, you will discover the significance of both current and available balances, how they affect your spending capabilities, and tips on tracking and managing your balance efficiently. Equipped with this knowledge, you will be better prepared to make informed financial decisions.

Whether you are a seasoned financial planner or someone just starting to manage your finances, this guide will walk you through everything you need to know about MyInflow current and available balance. Let’s explore these concepts and how they impact your financial health.

Table of Contents

What is Current Balance?

The current balance is the total amount of money in your account at any given moment. This figure reflects all transactions that have been posted, including deposits, withdrawals, and any other account activities that have been processed. It is important to note that the current balance may not always be the amount you can spend immediately.

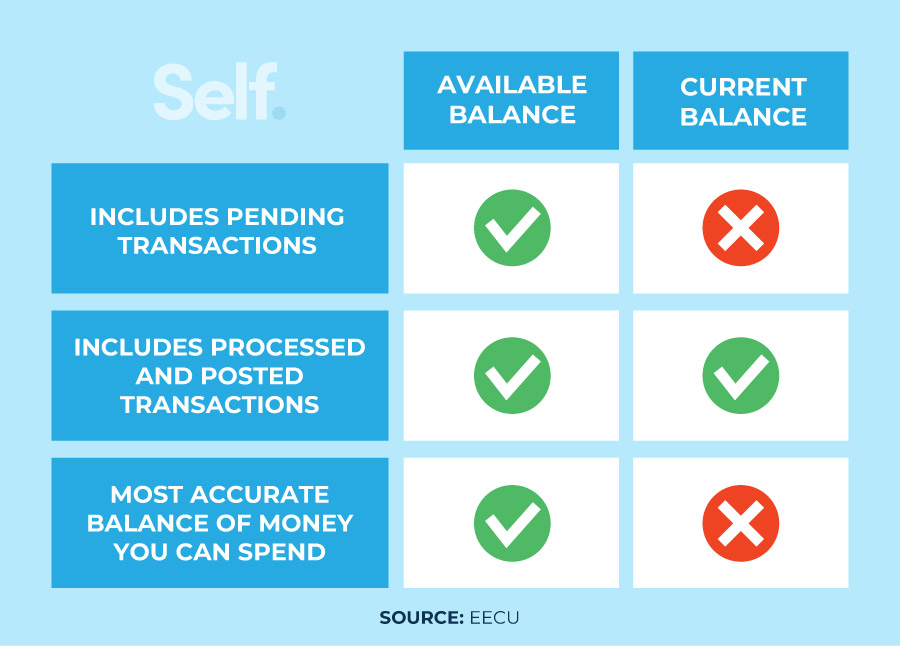

Characteristics of Current Balance

- Includes all cleared transactions.

- May not reflect pending transactions.

- Can fluctuate throughout the day.

What is Available Balance?

Available balance, on the other hand, is the amount of money you can use or withdraw at any given time. This figure takes into account any pending transactions that have not yet cleared, which means it may be lower than your current balance. Understanding your available balance is crucial for effective financial management.

Characteristics of Available Balance

- Reflects only the funds you can access immediately.

- Takes pending transactions into account.

- Helps avoid overdrafts and declined transactions.

Importance of Knowing Your Balances

Understanding the difference between current and available balance is essential for effective financial management. Knowing how much money you have available can help you avoid overdraft fees, declined transactions, and potential damage to your credit score. Here are some key reasons for keeping track of your balances:

- Prevents overspending.

- Ensures timely bill payments.

- Helps in budgeting and financial planning.

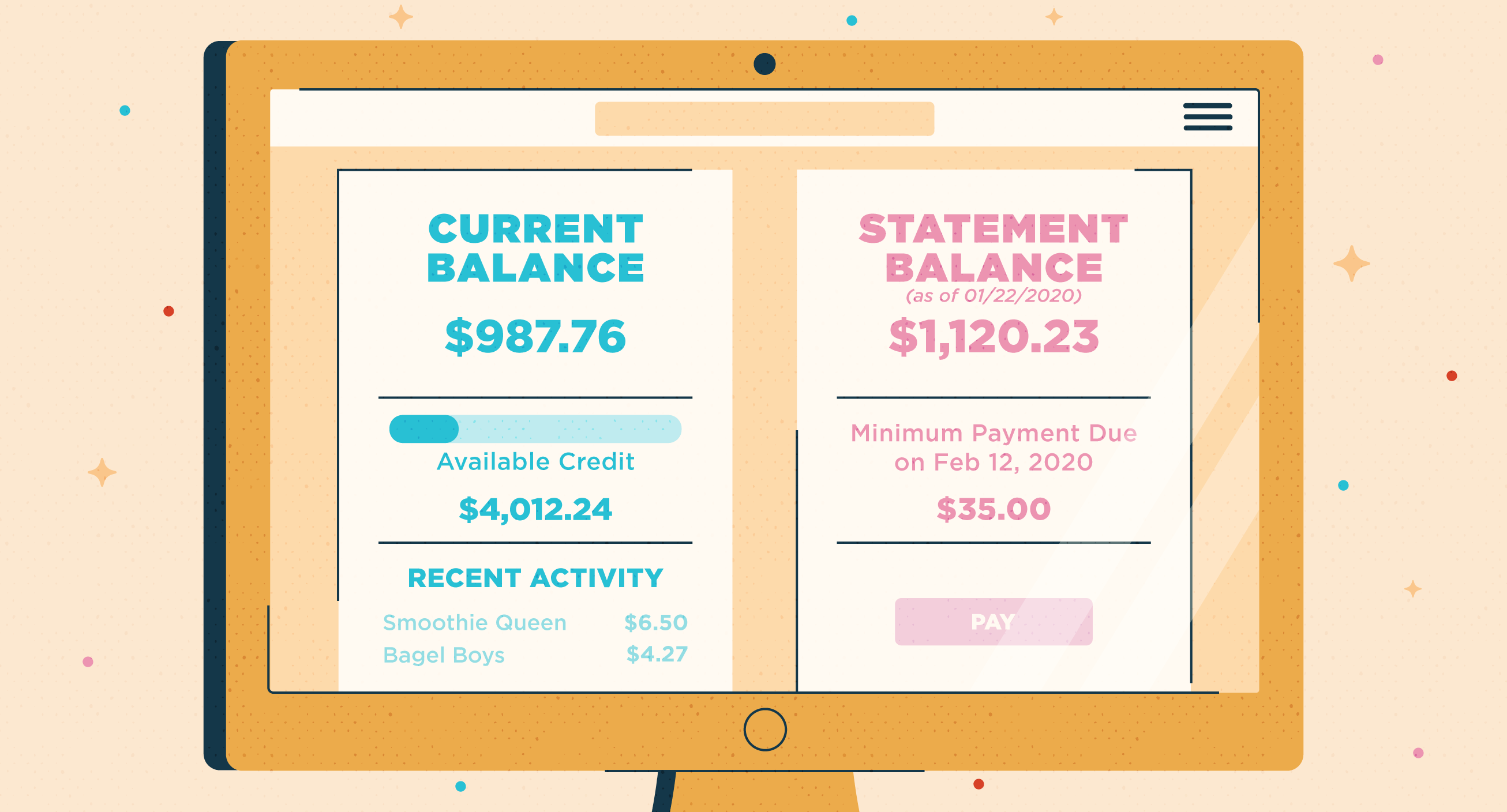

How to Check MyInflow Balance

Checking your MyInflow balance is a straightforward process. Here are the steps you need to follow:

- Log in to your MyInflow account.

- Navigate to the balance section.

- Review both your current and available balances.

Additionally, you can set up alerts to notify you of balance changes, which can help you stay on top of your finances.

Differences Between Current and Available Balance

While both current and available balances are important, they serve different purposes. Here’s a breakdown of their differences:

- Current Balance: Reflects all transactions processed.

- Available Balance: Indicates accessible funds considering pending transactions.

Impact on Your Financial Decisions

Your current and available balances can significantly impact your financial decisions. For example, if you only look at your current balance, you might think you have more money than you can actually spend. This misconception can lead to overspending and financial trouble.

Tips for Managing Your Balance

Here are some practical tips to help you manage your MyInflow current and available balances effectively:

- Regularly check your balance to stay informed.

- Keep track of pending transactions.

- Create a budget that accounts for your available funds.

- Set up alerts for low balances.

Conclusion

Understanding your MyInflow current and available balance is vital for effective financial management. By keeping track of both balances, you can make informed financial decisions, avoid unnecessary fees, and ensure that you are financially secure. Don't hesitate to ask questions or seek help if you are unsure about your balances.

We hope you found this article informative. If you have any thoughts or questions, please leave a comment below or share this article with others who might benefit from it. Explore more articles on our site for additional financial tips and insights!

Thank you for reading, and we look forward to seeing you back on our site for more valuable content!

Also Read

Article Recommendations

ncG1vNJzZmivp6x7tMHRr6CvmZynsrS71KuanqtemLyue9SspZ6vo258rsXIp52lp6disLa%2B0Z6lrWWRo7FurdWaoKWZkqGybq7ApZinm5VjtbW5yw%3D%3D