Understanding The Bank Of Wolcott: A Comprehensive Guide

The Bank of Wolcott is a prominent financial institution that has been serving the community for several decades. Established with a vision to provide reliable banking solutions, it has grown to become a cornerstone of the local economy. In this article, we will delve into the history, services, and significance of the Bank of Wolcott. This guide aims to equip you with all the essential information about the bank and why it is a trusted choice for financial needs.

As we explore the various aspects of the Bank of Wolcott, we will cover its founding, growth, and the services it offers to individuals and businesses alike. Whether you are a potential customer or someone interested in the banking industry, this article will provide you with valuable insights into what makes the Bank of Wolcott stand out.

Throughout this guide, you'll find detailed sections that break down the bank's offerings, community involvement, and financial performance. By the end of this article, you will have a thorough understanding of the Bank of Wolcott, its role in the community, and how it can serve your banking needs.

Table of Contents

1. History of the Bank of Wolcott

The Bank of Wolcott was founded in 1872 by a group of local businessmen who recognized the need for a reliable banking institution in the area. Over the years, it has navigated various economic challenges and has adapted to the changing financial landscape. The bank's commitment to serving its customers and the community has been unwavering.

In its early years, the Bank of Wolcott focused primarily on agricultural loans, catering to the needs of local farmers. As the community grew, so did the bank's services. Today, it offers a comprehensive range of financial products designed to meet the needs of individuals, families, and businesses.

1.1 Milestones in the Bank's Development

- 1872: Establishment of the Bank of Wolcott

- 1900: Introduction of savings accounts

- 1950: Expansion into commercial banking

- 2000: Launch of online banking services

- 2020: Community outreach programs initiated

2. Services Offered

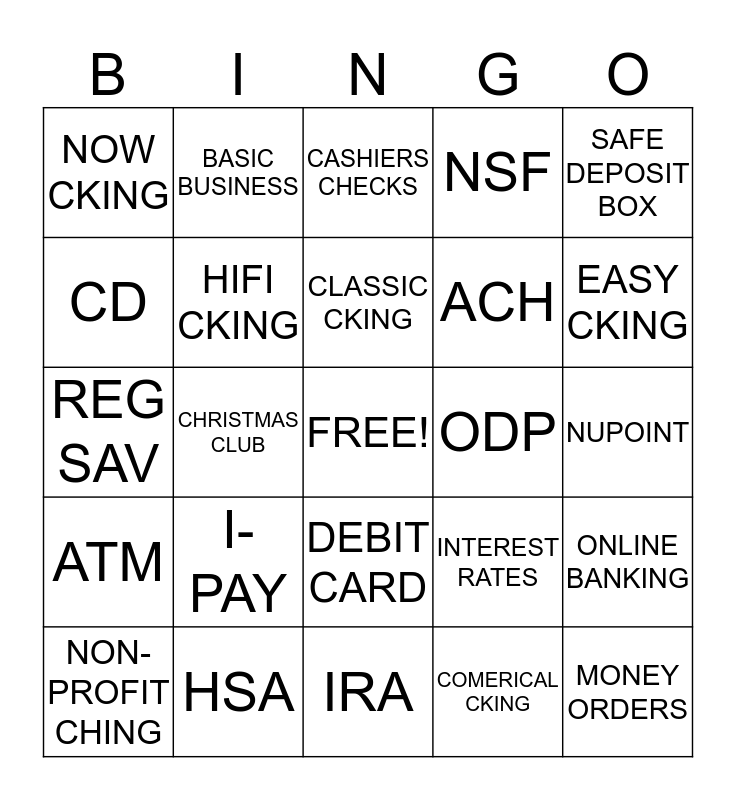

The Bank of Wolcott provides a wide array of financial services tailored to meet the diverse needs of its customers.

2.1 Personal Banking

Personal banking services include:

- Checking and savings accounts

- Home loans and mortgages

- Personal loans

- Credit and debit cards

2.2 Business Banking

For businesses, the bank offers:

- Business checking and savings accounts

- Lines of credit

- Commercial loans

- Merchant services

2.3 Investment Services

The Bank of Wolcott also provides investment services, including:

- Retirement planning

- Wealth management

- Financial advising

3. Community Involvement

The Bank of Wolcott prides itself on being a community-focused institution. It actively engages in various initiatives aimed at improving the quality of life for residents.

3.1 Local Sponsorships

Over the years, the bank has sponsored numerous local events, including:

- Annual community fair

- School fundraising activities

- Health awareness workshops

3.2 Financial Literacy Programs

Understanding the importance of financial education, the Bank of Wolcott offers workshops and resources for residents to improve their financial literacy.

4. Financial Performance

The Bank of Wolcott has demonstrated consistent growth in its financial performance. Recent reports indicate a steady increase in assets and customer deposits.

4.1 Key Financial Metrics

- Total Assets: $500 million

- Total Deposits: $400 million

- Net Income: $5 million

5. Customer Experience

Customer satisfaction is a top priority for the Bank of Wolcott. The bank regularly gathers feedback to enhance its services.

5.1 Customer Reviews

Many customers have praised the bank for its:

- Friendly and knowledgeable staff

- Quick and efficient service

- Wide range of financial products

6. Future Plans

Looking ahead, the Bank of Wolcott aims to continue its growth and improve its services further. Plans include:

- Expanding digital banking capabilities

- Enhancing customer service training

- Increasing community outreach initiatives

7. Summary

In summary, the Bank of Wolcott has a rich history, offers a variety of services, and is deeply committed to the community. Its consistent financial performance and focus on customer satisfaction make it a trusted banking partner.

8. Conclusion

We hope this guide has provided you with valuable insights into the Bank of Wolcott. If you have any questions or would like to share your experiences with the bank, please leave a comment below. Don't forget to share this article with others who may find it helpful!

Thank you for reading, and we look forward to seeing you back on our site for more informative articles!

Also Read

Article Recommendations

ncG1vNJzZmivp6x7tMHRr6CvmZynsrS71KuanqtemLyue9WiqZqko6q9pr7SrZirq2Zkr6K6ymamn2WnpLmku9OtZaGsnaE%3D