Understanding The Dynamics Of USA House Prices Vs Income

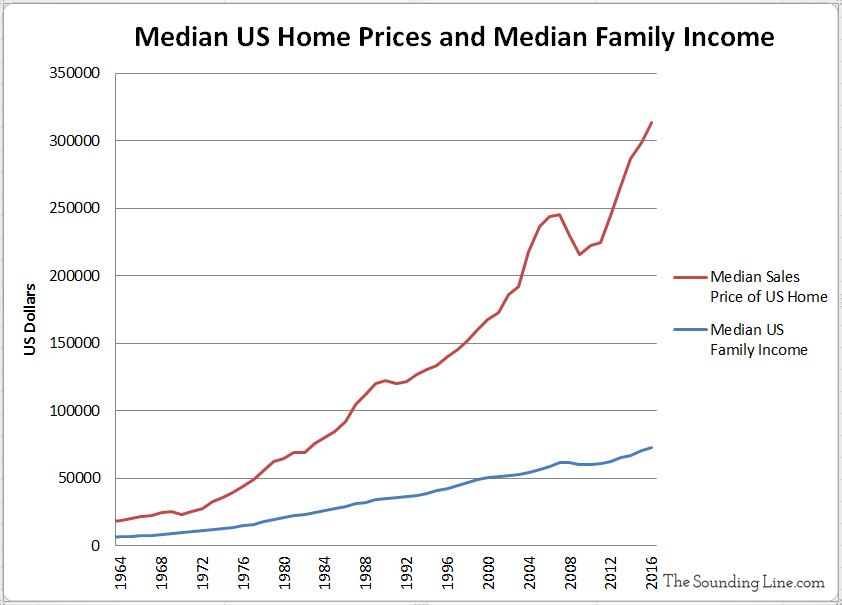

The relationship between house prices and income in the United States is a crucial aspect of the economy that affects millions of individuals and families. As housing markets continue to fluctuate, understanding how these two variables interact can provide valuable insights into affordability, economic stability, and the overall quality of life for Americans. With rising house prices and stagnant incomes, many potential homeowners are left grappling with the challenge of achieving homeownership in today's market.

In recent years, the disparity between median home prices and average household incomes has reached alarming levels in many regions across the country. This growing divide raises significant questions about the sustainability of the current housing market and the long-term implications for both buyers and renters alike. The ability to purchase a home has become increasingly out of reach for many, leading to a surge in demand for rental properties and alternative housing solutions.

As we delve into the complexities of USA house prices vs income, we will explore various factors that contribute to this phenomenon, such as economic trends, demographic shifts, and government policies. By examining these elements, we can better understand the implications for future homebuyers and the overall housing market landscape.

What Are the Current Trends in USA House Prices vs Income?

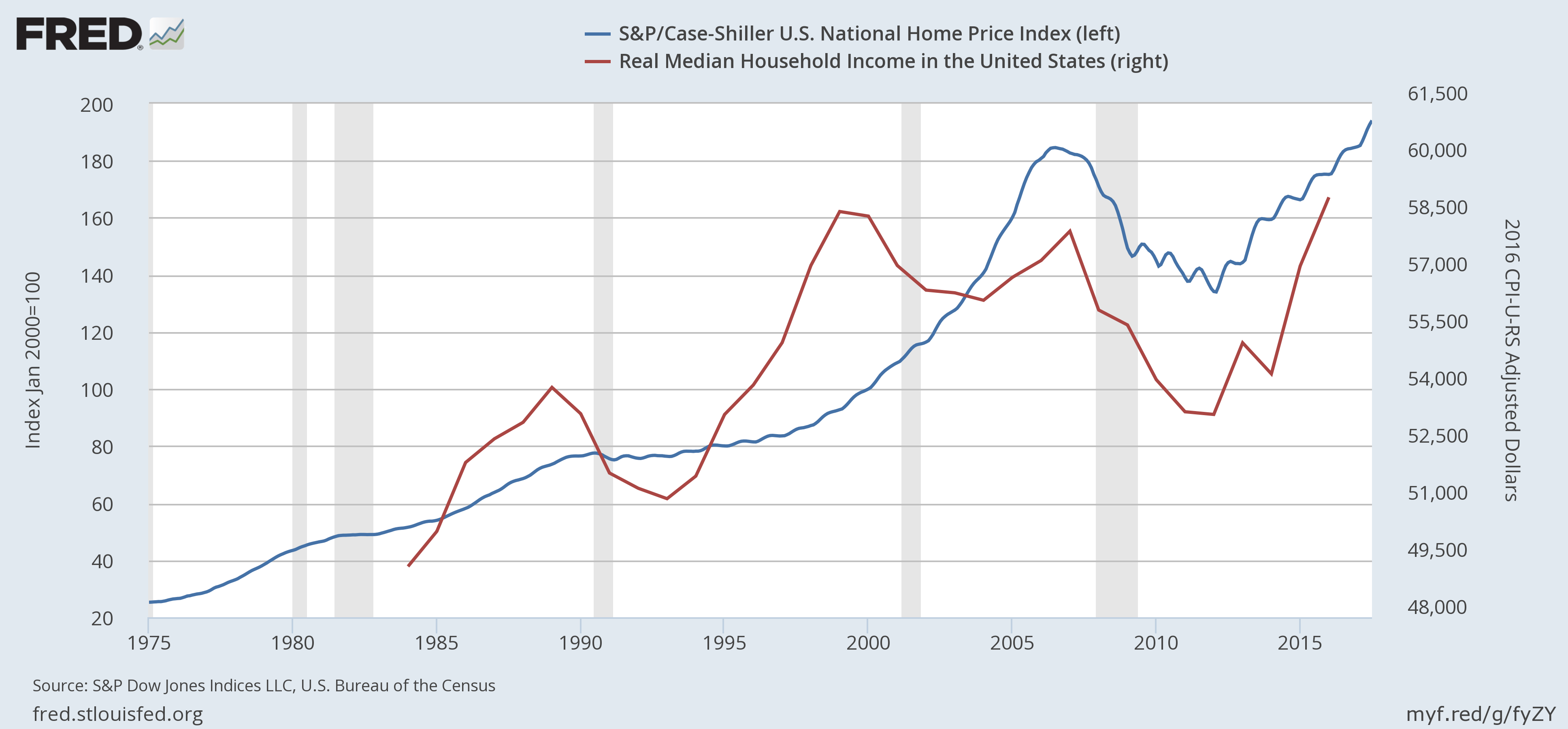

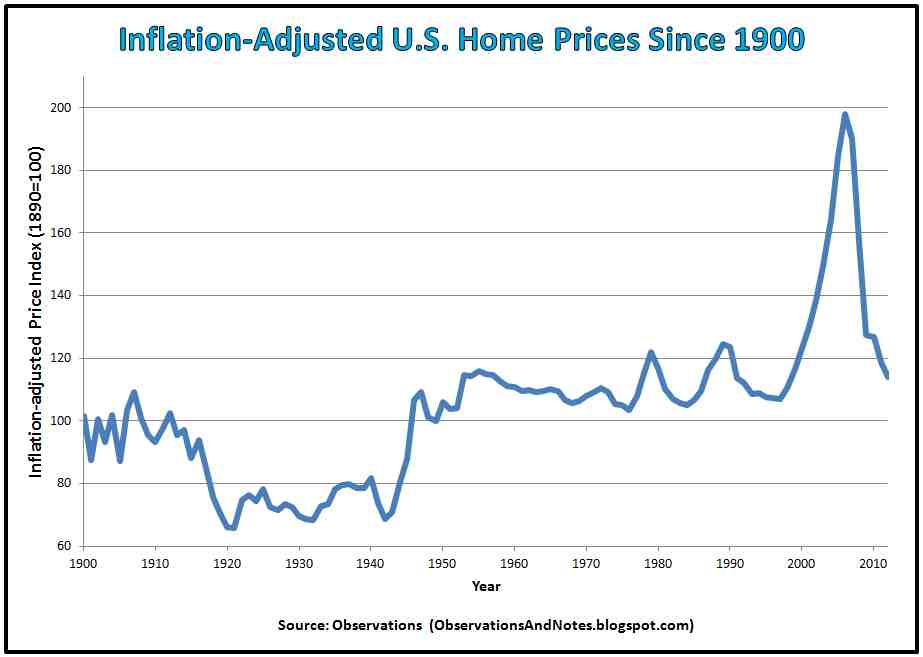

The trends in house prices and income across the United States reveal a stark contrast. Over the past decade, median home prices have surged, particularly in metropolitan areas. In contrast, income growth has not kept pace, leading to increasing affordability challenges for prospective homebuyers.

How Do Regional Variations Impact House Prices and Income?

Regional differences play a significant role in the dynamics of house prices vs income. For instance, cities like San Francisco and New York have some of the highest housing costs compared to median incomes, while areas in the Midwest may offer more favorable conditions for buyers. Understanding these regional variations is essential for prospective homeowners and investors alike.

What Factors Contribute to Rising House Prices?

- Supply and Demand: A lack of available housing can drive prices up.

- Interest Rates: Low mortgage rates can encourage buyers to enter the market, raising prices.

- Economic Growth: Strong job markets often attract more buyers, increasing demand.

- Government Policies: Zoning laws and regulations can affect housing availability.

What Are the Implications of Rising House Prices on Income Disparity?

The widening gap between house prices and income can lead to significant implications for society. As homeownership becomes less attainable, more individuals may find themselves renting long-term, which can lead to increased wealth disparity and socioeconomic challenges.

How Can Potential Homebuyers Navigate the Challenges?

Potential homebuyers must adopt strategic approaches to navigate the challenges posed by rising house prices. Some effective strategies include:

What Role Do Government Policies Play in the Housing Market?

Government policies have a profound impact on the housing market and can either exacerbate or alleviate the challenges of house prices vs income. Policies related to zoning, taxation, and housing assistance programs can influence supply and demand dynamics, ultimately affecting affordability for potential buyers.

What Are the Future Predictions for USA House Prices vs Income?

As we look ahead, predictions for the future of USA house prices vs income remain uncertain. Various experts suggest that while prices may stabilize in some areas, economic factors such as inflation, interest rates, and demographic shifts will continue to play a crucial role in shaping the housing market landscape.

How Can Understanding House Prices vs Income Inform Investment Decisions?

For investors, understanding the relationship between house prices and income can provide valuable insights into potential investment opportunities. By analyzing areas with favorable income-to-price ratios, investors can identify markets that may offer better returns on investment.

Conclusion: Navigating the Landscape of USA House Prices vs Income

The ongoing dynamics of USA house prices vs income present both challenges and opportunities for individuals, families, and investors. By staying informed and adapting strategies to the current market conditions, prospective homeowners can better position themselves for success in a complex housing landscape. Whether through government assistance programs, market research, or alternative housing options, understanding the intricacies of this relationship is essential for navigating the ever-changing world of real estate.

Also Read

Article Recommendations

ncG1vNJzZmivp6x7tMHRr6CvmZynsrS71KuanqtemLyue9OrsJ6bmKSFcMHSmmShp6Wosm680aKanqtdq8Butc2cpqadXp3Brrg%3D