Understanding The Fed Watch Tool: A Comprehensive Guide

The Fed Watch Tool is an essential resource for investors and economists alike, providing insights into the potential future actions of the Federal Reserve. In the constantly shifting landscape of the financial markets, understanding the Federal Reserve's decisions can be the difference between profit and loss. This comprehensive guide will delve into the features, benefits, and significance of the Fed Watch Tool, all while ensuring you gain the insights necessary to make informed financial decisions.

Throughout this article, we will explore not just what the Fed Watch Tool is, but also how to effectively use it to your advantage. By the end, you should feel confident in your ability to interpret the data it provides and apply it to your investment strategies. Whether you are a seasoned investor or just starting, the information here will enhance your understanding of Federal Reserve dynamics.

Join us as we uncover the intricacies of the Fed Watch Tool, equipping you with the knowledge to navigate the challenges of the financial world with confidence. Let’s get started!

Table of Contents

The Fed Watch Tool is a financial market forecasting tool that provides insights into the likelihood of changes in the Federal Reserve's monetary policy, particularly changes in interest rates. It leverages data from the futures markets to gauge investor sentiment about the direction the Fed may take based on economic indicators and other relevant data.

It is primarily used by traders, analysts, and investors to forecast potential shifts in monetary policy that could affect the economy and financial markets. By assessing the probabilities of rate changes, users can make more informed investment decisions.

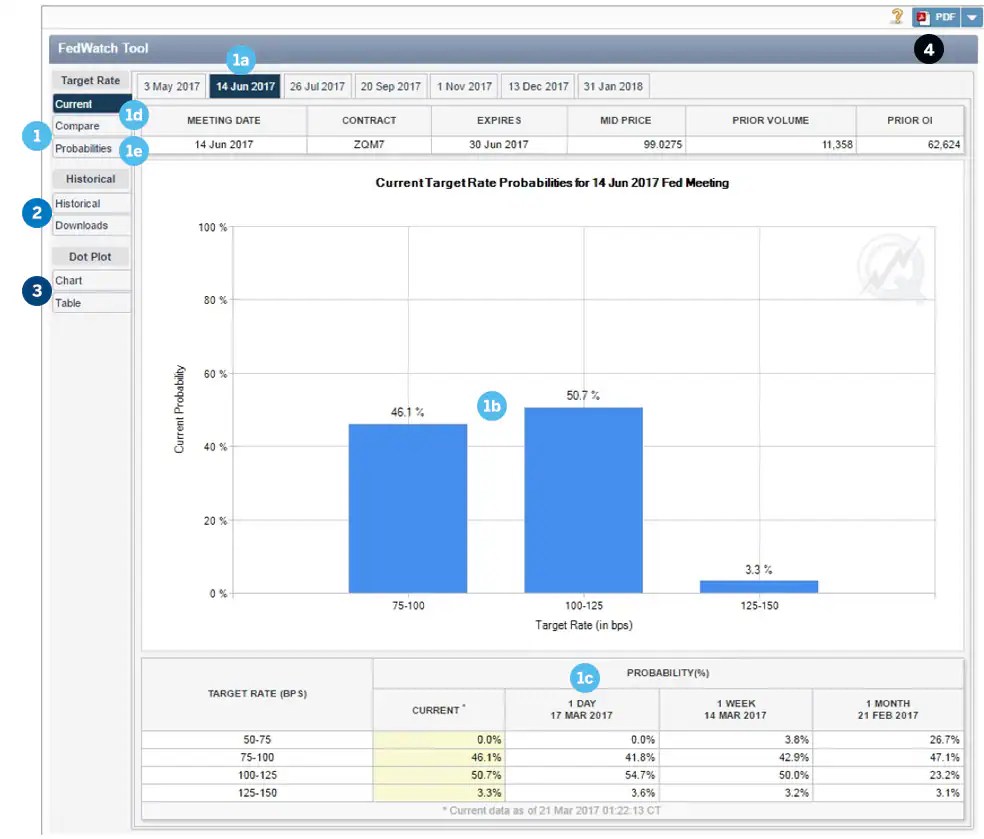

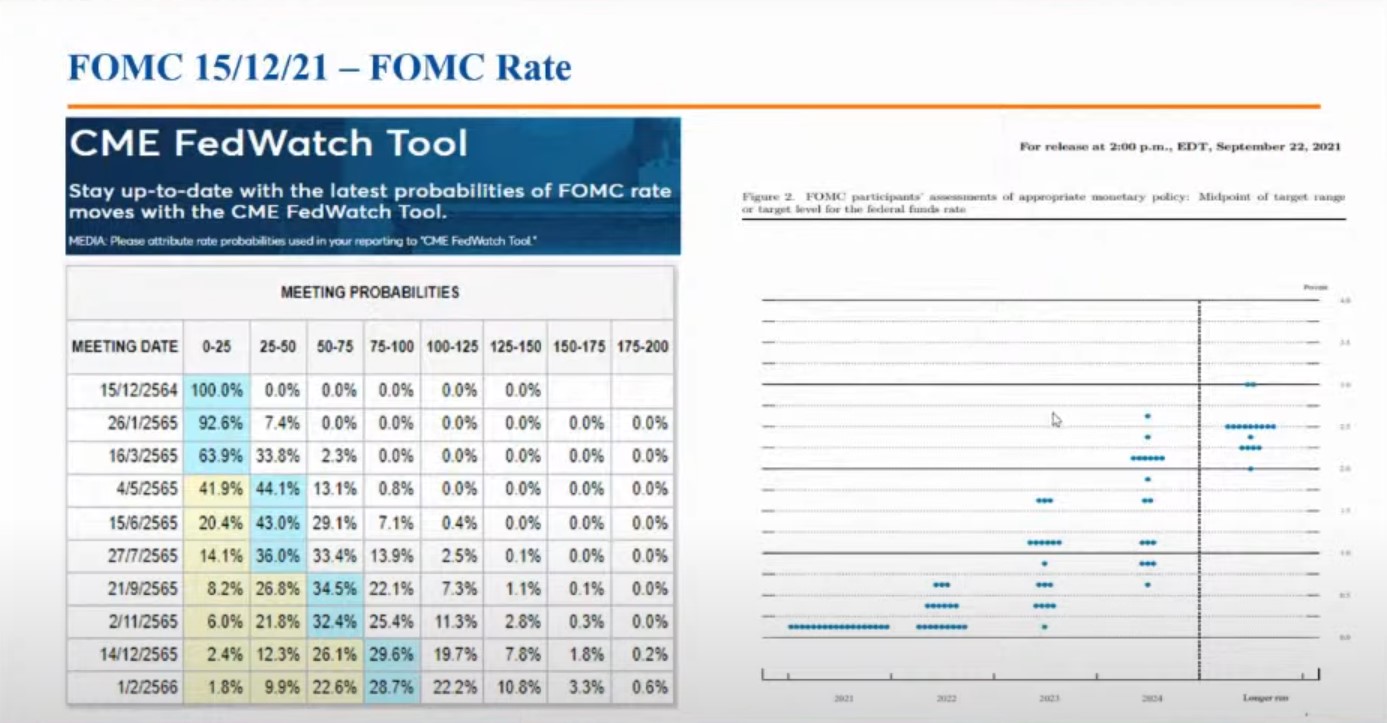

How the Fed Watch Tool Works

The Fed Watch Tool analyzes the prices of interest rate futures contracts to estimate the probabilities of various interest rate outcomes at upcoming Federal Open Market Committee (FOMC) meetings. These probabilities are then displayed in a user-friendly format, showing the likelihood of rate hikes, cuts, or maintaining the current rates.

Understanding the Federal Reserve's actions is crucial for anyone involved in the financial markets. The Fed Watch Tool serves as a vital resource that offers transparency into market expectations regarding monetary policy. Here are several reasons why the Fed Watch Tool is important:

- Informed Decision-Making: Traders and investors can make more educated decisions based on the likelihood of interest rate changes.

- Market Sentiment Analysis: The tool allows users to gauge market sentiment and adjust their strategies accordingly.

- Risk Management: By understanding potential rate changes, investors can better manage their portfolios and mitigate risks.

- Economic Forecasting: The Fed Watch Tool provides insights into broader economic trends and potential future conditions.

Using the Fed Watch Tool effectively requires a basic understanding of its components and how to interpret the data it provides. Here’s how you can utilize the tool:

- Access the Tool: Navigate to the official website or financial platforms that provide access to the Fed Watch Tool.

- Review the Probability Chart: The main feature of the tool is the probability chart, which displays the likelihood of various interest rate scenarios.

- Analyze Historical Data: Look at historical trends to see how previous predictions matched actual outcomes.

- Combine with Other Analyses: Use the Fed Watch Tool in conjunction with other economic indicators for a comprehensive analysis.

The Fed Watch Tool comes with several key features that enhance its usability and effectiveness:

- Real-Time Data: The tool provides real-time updates on interest rate probabilities.

- Interactive Charts: Users can interact with charts to see how probabilities change leading up to FOMC meetings.

- Historical Analysis: The tool allows users to review historical data to better understand past predictions.

- Integration with Financial News: The tool is often integrated with financial news to provide context for the probabilities presented.

Understanding how to interpret the data provided by the Fed Watch Tool is crucial. Here are some tips:

- Focus on Probabilities: Look at the percentages for each potential interest rate change scenario.

- Compare Scenarios: Assess the difference between the probabilities for rate hikes, cuts, and maintaining rates.

- Pay Attention to Trends: Observe how the probabilities shift leading up to FOMC meetings, as this can indicate market sentiment.

- Contextualize with Economic Data: Always correlate the probabilities with recent economic data releases for a fuller understanding.

Case Studies: Fed Watch Tool in Action

To illustrate the effectiveness of the Fed Watch Tool, let’s examine a couple of case studies where the tool provided valuable insights:

Case Study 1: Anticipating Rate Hikes

In 2022, as inflation rates began to rise, the Fed Watch Tool indicated a growing probability of interest rate hikes. Investors who utilized this information were able to adjust their portfolios ahead of the Fed's decision, leading to more favorable outcomes.

Case Study 2: Navigating Market Volatility

During periods of economic uncertainty, such as the COVID-19 pandemic, the Fed Watch Tool provided critical insights into potential rate cuts. This allowed investors to hedge against market volatility effectively.

Challenges and Limitations of the Fed Watch Tool

While the Fed Watch Tool is a powerful resource, it is not without its challenges and limitations:

- Market Speculation: The tool relies on market sentiment, which can sometimes be driven by speculation rather than fundamentals.

- Data Lag: There may be delays in data updates, leading to outdated information at times.

- Complexity for Beginners: New users may find it challenging to interpret the data without a solid understanding of economic principles.

As financial markets evolve, so too will the Fed Watch Tool. Future enhancements may include:

- Advanced Analytics: Incorporating machine learning and AI to provide more accurate predictions.

- Mobile Accessibility: Improving access through mobile platforms for on-the-go analysis.

- Increased Integration: Collaborating with other financial tools for a more comprehensive market analysis.

Conclusion

In summary, the Fed Watch Tool is an invaluable resource for anyone involved in finance. By understanding how to leverage the tool, you can navigate the complexities of monetary policy and make informed investment decisions. We encourage you to explore the Fed Watch Tool further, utilize it in your market analyses, and share your thoughts in the comments below.

Call to Action

If you found this article helpful, please consider sharing it with others who may benefit from understanding the Fed Watch Tool. Additionally, check out other articles on our site for more insights into financial markets and investment strategies.

Final Thoughts

Thank you for reading! We hope you return to our site for more informative content in the future. Stay informed, stay engaged, and happy investing!

Also Read

Article Recommendations

ncG1vNJzZmivp6x7tMHRr6CvmZynsrS71KuanqtemLyue9KtmKtlpJ64tbvKcGafnZRixKLAwqFkraefoXupwMyl