Understanding The Risks Of Stolen Mail: Checks And Credit Cards

In today’s fast-paced digital world, the security of our personal information is more crucial than ever. One major concern that continues to plague individuals and businesses alike is the theft of mail, particularly checks and credit cards. The rise in mail theft incidents can lead to severe financial repercussions and identity theft, making it essential for everyone to be aware of how to protect themselves. This article delves into the implications of stolen mail checks and credit cards, providing insights on prevention, recovery, and resources to safeguard your financial health.

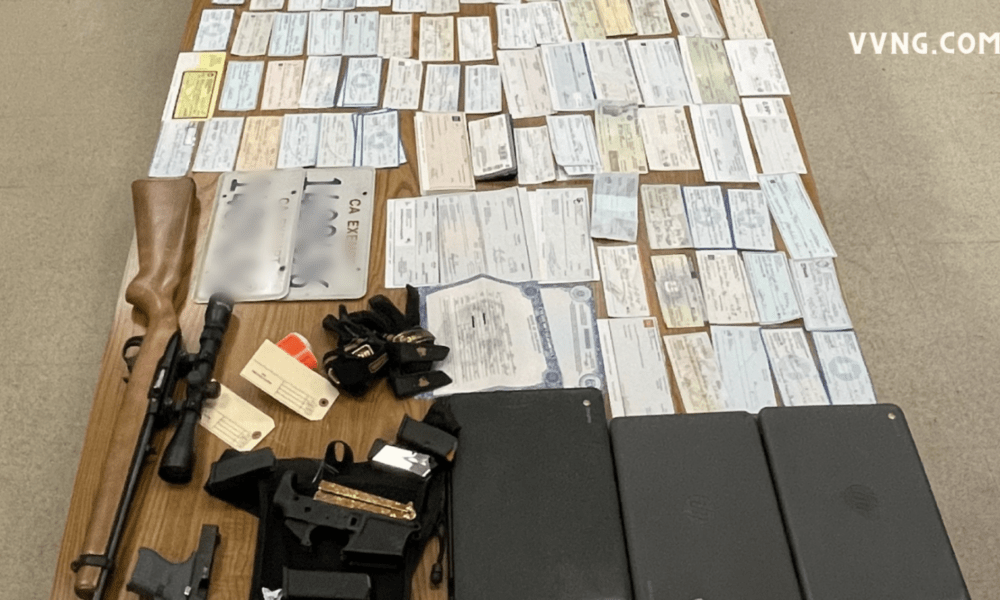

The theft of checks and credit cards from the mail not only affects individuals but also poses a significant risk to businesses. With the convenience of electronic transactions, many people still rely on traditional mail for payments and account management. Unfortunately, this reliance creates an opportunity for criminals to exploit vulnerabilities. By understanding the methods used by thieves and the consequences of stolen mail, you can take proactive steps to protect your financial assets.

This comprehensive guide will equip you with essential knowledge regarding stolen mail checks and credit cards. We will explore the risks involved, preventative measures, and what to do if you find yourself a victim of mail theft. By arming yourself with information, you can enhance your financial security and mitigate the risks associated with stolen mail.

Table of Contents

1. The Risks of Stolen Mail Checks and Credit Cards

The risks associated with stolen mail checks and credit cards are extensive. When thieves obtain your checks or credit cards, they can:

- Access your bank account information

- Make unauthorized purchases

- Commit identity theft

- Damage your credit score

Each of these risks can lead to significant financial loss and emotional distress. According to the Federal Trade Commission (FTC), millions of Americans fall victim to identity theft each year, with stolen checks and credit cards being among the most common methods.

2. Common Methods of Mail Theft

Thieves employ various tactics to steal checks and credit cards from the mail. Understanding these methods can help you recognize potential threats. Some common techniques include:

2.1 Mailbox Fishing

Thieves often use devices to fish out mail from unsecured mailboxes. This method involves inserting a tool into the mailbox to retrieve checks and credit cards.

2.2 Package Theft

With the increase in online shopping, package theft has become prevalent. Thieves steal packages containing checks or credit cards delivered by postal services.

2.3 Intercepting Mail

Some thieves may go as far as to redirect your mail to another address. This method requires personal information, making it essential to safeguard your details.

3. Prevention Strategies

Taking proactive measures is essential in preventing mail theft. Here are some effective strategies:

- Use a secure mailbox with a lock.

- Opt for electronic statements and bill payments.

- Retrieve your mail promptly, especially checks.

- Consider using a PO Box for sensitive mail.

- Install a security camera in the vicinity of your mailbox.

4. What to Do If Your Mail is Stolen

If you suspect that your mail has been stolen, it’s crucial to act quickly. Follow these steps:

- Contact your bank and credit card companies immediately.

- Place a fraud alert on your credit report.

- Monitor your financial accounts for unauthorized transactions.

- File a police report to document the theft.

5. Reporting Stolen Checks and Credit Cards

Reporting stolen checks and credit cards is a critical step in recovery. Here’s how to proceed:

- Report stolen checks to your bank, and provide them with details.

- Contact credit card companies to freeze or cancel your cards.

- File a report with the FTC at IdentityTheft.gov.

- Notify the United States Postal Inspection Service if your mail was intercepted.

6. The Impact of Mail Theft on Your Credit

Stolen mail can profoundly affect your credit score. Unpaid bills and unauthorized transactions can lead to negative credit reporting. Here are some impacts of mail theft:

- Late payments on accounts due to stolen checks.

- Increased credit utilization from unauthorized purchases.

- Potential legal issues if the thief uses your information for fraud.

7. Resources for Victims of Mail Theft

If you find yourself a victim of mail theft, numerous resources are available to assist you:

8. Conclusion

In conclusion, the theft of mail checks and credit cards poses a significant threat to individuals and businesses. By understanding the risks, employing prevention strategies, and knowing how to respond if your mail is stolen, you can protect yourself from the severe repercussions of this crime. Stay vigilant, safeguard your information, and make use of the resources available to you. If you found this article helpful, feel free to leave a comment, share it with others, or explore more articles on our site.

Final Thoughts

Mail theft is a serious issue that requires our attention and action. By taking proactive steps and remaining informed, you can significantly reduce the risk of becoming a victim. Remember, a secure mailbox and prompt retrieval of your mail can make all the difference in protecting your financial health.

Also Read

Article Recommendations

ncG1vNJzZmivp6x7tMHRr6CvmZynsrS71KuanqtemLyue9SspZ6vo258tMDOpZynZZ2Wtq15wqGcnKOjYrCzscOiq2abkaextHrHraSl