Understanding The State Of New Jersey Pension System

The state of New Jersey pension system is a critical component of the financial security for thousands of public employees and retirees. As one of the most prominent pension systems in the United States, it serves as a lifeline for many individuals who have dedicated their careers to public service. However, navigating the complexities of this system can be daunting, especially for those who are nearing retirement or newly employed within the state. With a range of pension plans and regulations, understanding the intricacies of the state of New Jersey pension system is essential for effective planning and financial literacy.

In recent years, the state of New Jersey pension system has faced significant challenges, including funding shortfalls and legislative changes that impact both current employees and retirees. These challenges have raised questions about the sustainability of the pension system and the future of public employee benefits in New Jersey. As the state government grapples with budget constraints and economic pressures, it is crucial for stakeholders to stay informed about potential reforms and the implications for their pensions.

As we dive deeper into the state of New Jersey pension system, we will explore its history, current state, and future prospects. By shedding light on various aspects of the pension system, we aim to empower public employees, retirees, and policymakers with the knowledge needed to navigate this complex landscape. Whether you are a teacher, police officer, or government employee, understanding your rights and benefits within the state of New Jersey pension system is vital for securing your financial future.

What is the Current Status of the State of New Jersey Pension System?

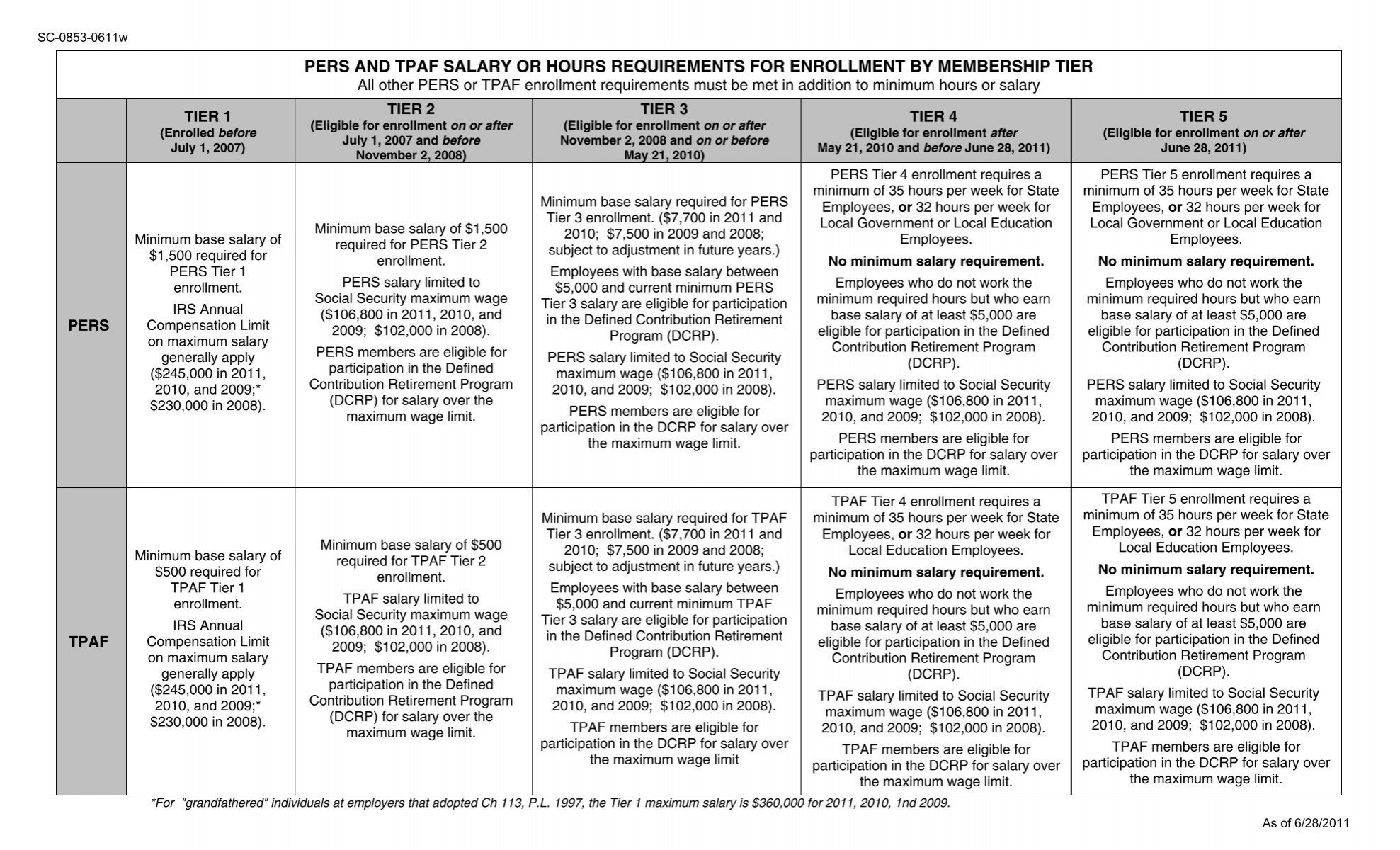

The state of New Jersey pension system is composed of multiple retirement plans that serve different categories of public employees, including teachers, state workers, and local government employees. As of the latest reports, the system has been facing significant funding challenges. The pension system's funded ratio, which measures the plan's assets against its liabilities, is below the national average, raising concerns about its long-term viability.

How Do Pension Plans Work in New Jersey?

Pension plans in New Jersey operate under different structures, primarily defined benefit plans and defined contribution plans. The majority of public employees are covered by a defined benefit plan, which provides guaranteed retirement income based on a formula that considers years of service and final salary. In contrast, defined contribution plans, such as 401(k) or 457 plans, allow employees to contribute a portion of their salary to an investment account, with no guaranteed payout upon retirement.

What Are the Key Pension Plans in New Jersey?

- Public Employees' Retirement System (PERS): Covers most state and local employees.

- Teachers' Pension and Annuity Fund (TPAF): Specifically for public school teachers.

- Police and Firemen's Retirement System (PFRS): Designed for law enforcement and firefighters.

- State Police Retirement System (SPRS): For New Jersey State Police members.

Are There Any Recent Legislative Changes Affecting the State of New Jersey Pension?

In recent years, lawmakers have introduced several reforms aimed at stabilizing the state of New Jersey pension system. These reforms have included adjusting contribution rates for employees and employers, increasing retirement age, and modifying benefit calculations. While some reforms aim to improve the system's financial health, they have also sparked debates among public employees and advocates regarding their fairness and impact on retirement security.

What Challenges Does the New Jersey Pension System Face?

The state of New Jersey pension system is grappling with various challenges, including:

- Funding Shortfalls: The pension system is underfunded, leading to concerns about its ability to meet future obligations.

- Investment Performance: Market fluctuations and investment returns impact the system's financial status.

- Demographic Changes: An aging workforce and increasing number of retirees place additional strain on the system.

- Political Factors: Budgetary constraints and political decisions affect funding and reforms.

How Can Employees Prepare for Retirement Under the State of New Jersey Pension System?

Preparation for retirement under the state of New Jersey pension system involves understanding your specific plan, calculating potential benefits, and considering additional savings options. Employees should take the following steps:

What Resources Are Available for Understanding the State of New Jersey Pension System?

Several resources are available to help public employees and retirees understand the state of New Jersey pension system:

- New Jersey Division of Pensions and Benefits: The official state website provides detailed information about pension plans, benefits, and updates.

- Financial Advisors: Consulting with a financial advisor can provide personalized guidance based on individual circumstances.

- Retirement Planning Workshops: Many organizations offer workshops focused on retirement planning and pension understanding.

Conclusion: What Does the Future Hold for the State of New Jersey Pension System?

The state of New Jersey pension system is at a crossroads, facing both challenges and opportunities for reform. As public employees and retirees navigate this complex landscape, understanding the intricacies of the pension system is crucial for financial security. By staying informed, preparing for retirement, and engaging in discussions about the future of the pension system, stakeholders can contribute to a more sustainable and equitable solution for all involved.

Also Read

Article Recommendations

ncG1vNJzZmivp6x7tMHRr6CvmZynsrS71KuanqtemLyue9WiqZqko6q9pr7SrZirq2NkwLWt055kqJ5do7K4ecmeqaydqWK9prrSoqanZpipuq0%3D