Understanding The Thinkorswim OSC Indicator: A Comprehensive Guide

The Thinkorswim OSC Indicator is a powerful tool in the arsenal of traders seeking to enhance their market analysis and trading strategies. This indicator plays a crucial role in identifying potential market trends and price movements, making it essential for both novice and experienced traders. In this article, we will delve deep into the functionality, benefits, and practical applications of the Thinkorswim OSC Indicator, providing you with valuable insights to improve your trading performance.

With the ever-evolving landscape of financial markets, utilizing advanced tools like the Thinkorswim OSC Indicator can give traders a competitive edge. Understanding how to effectively use this indicator can significantly impact trading outcomes, allowing for more informed decision-making. This guide aims to explore the various aspects of the OSC Indicator, including its features, how to interpret its signals, and best practices for incorporating it into your trading strategy.

By the end of this article, you will have a thorough understanding of the Thinkorswim OSC Indicator and how it can be leveraged to enhance your trading experience. Whether you are looking to refine your strategies or just starting, this comprehensive guide will equip you with the knowledge needed to navigate the complexities of trading with confidence.

Table of Contents

What is the OSC Indicator?

The OSC (On Balance Volume) Indicator is a technical analysis tool that correlates price movements with volume flow. It was developed to help traders assess buying and selling pressure in the market. The basic premise of the OSC Indicator is that volume precedes price, meaning that changes in volume can often indicate future price movements.

Features of the OSC Indicator

The OSC Indicator comes with several features that make it a valuable asset for traders:

- Volume Analysis: The OSC Indicator analyzes the volume of trades to identify trends.

- Trend Confirmation: It helps confirm the strength of a trend based on volume changes.

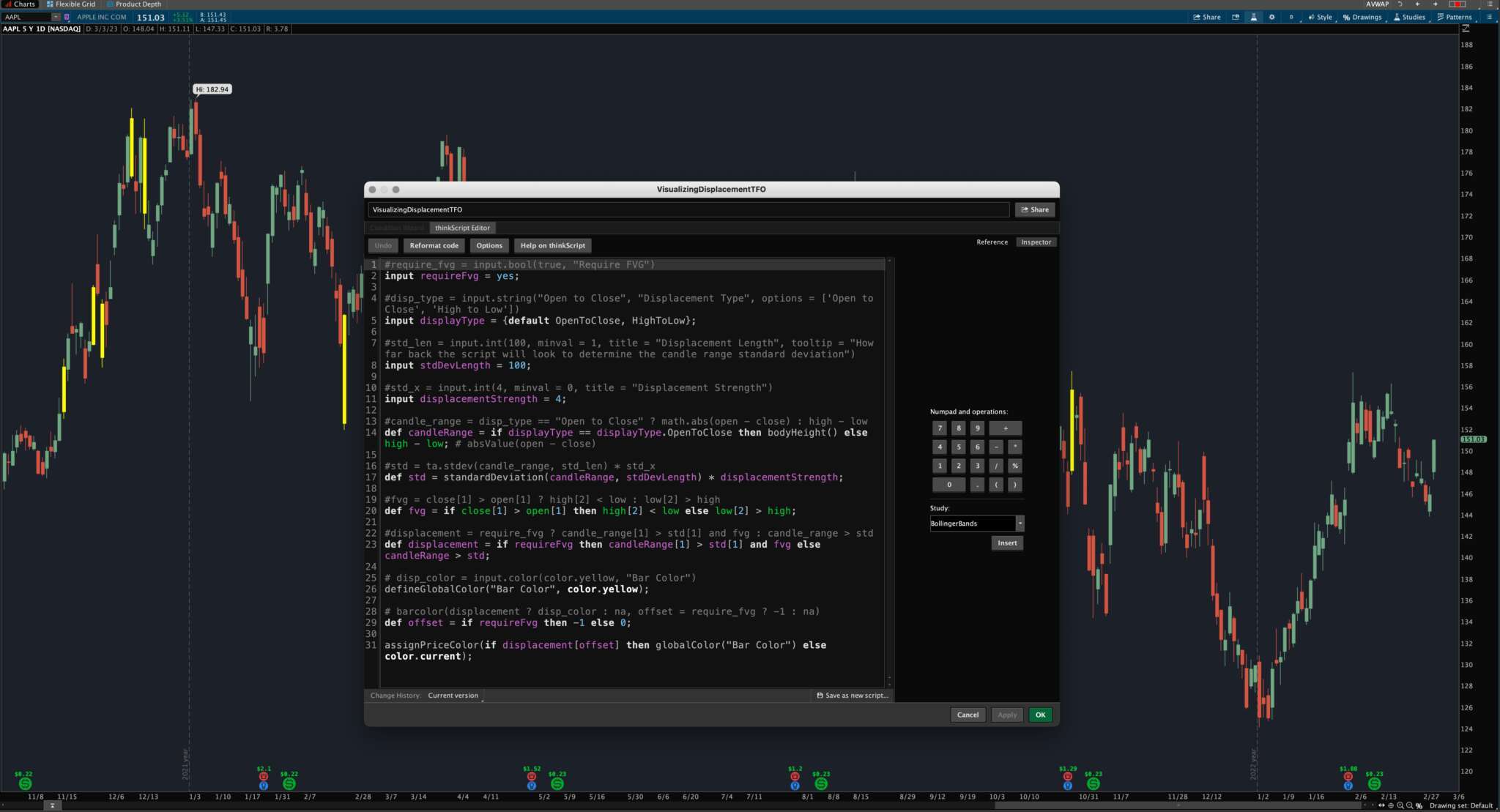

- Customizable Settings: Users can adjust the indicator settings according to their trading preferences.

How to Use the OSC Indicator

Using the OSC Indicator effectively requires understanding its functionalities and settings. Follow these steps to incorporate the OSC Indicator into your trading strategy:

Interpreting OSC Indicator Signals

Understanding how to interpret the signals generated by the OSC Indicator is crucial for making informed trading decisions. Here are the two primary types of signals:

Bullish and Bearish Signals

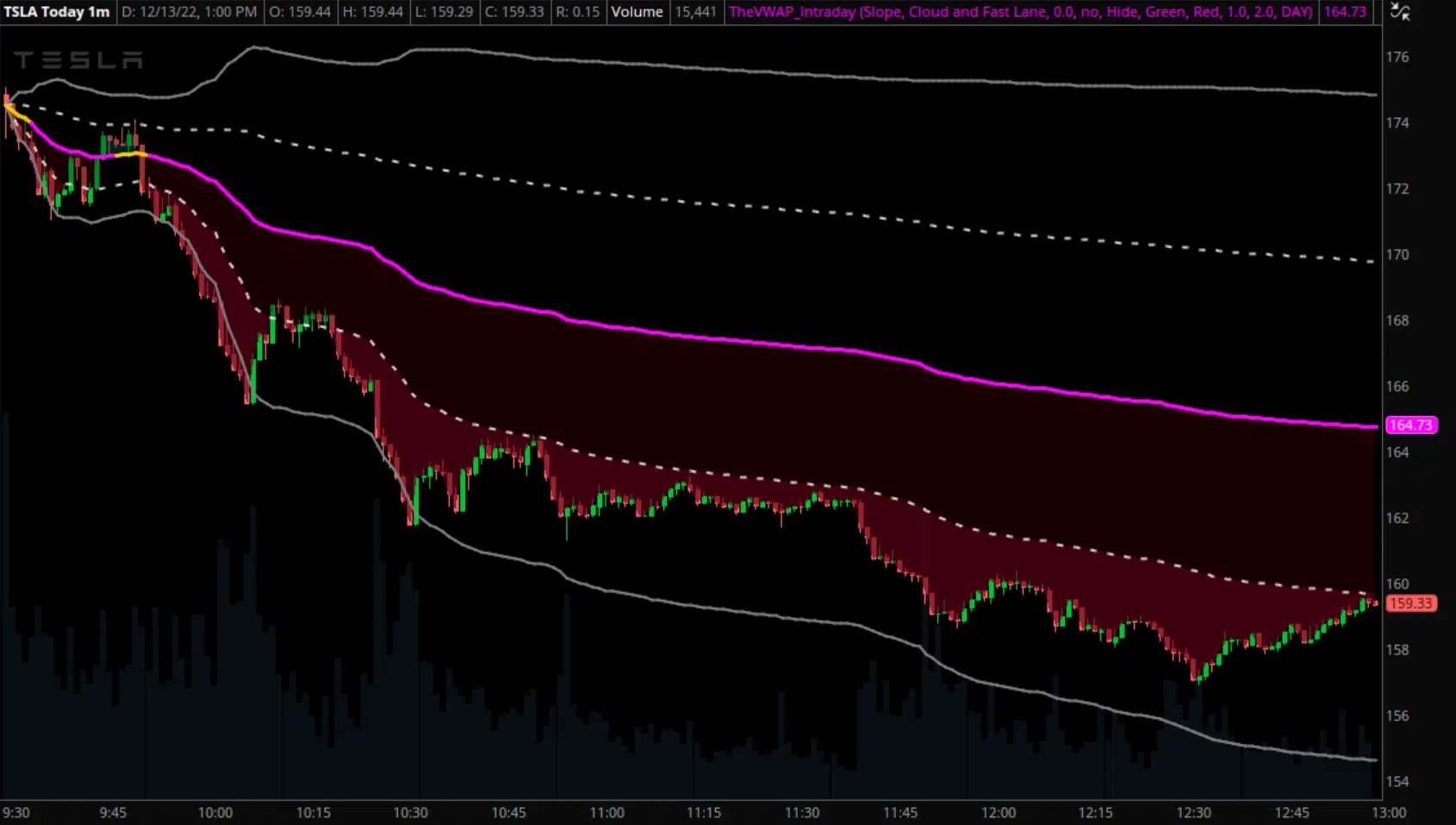

Bullish signals occur when the OSC Indicator rises above its previous highs, indicating an increase in buying pressure. Conversely, bearish signals arise when the indicator falls below its past lows, suggesting increased selling pressure.

Divergence Signals

Divergence occurs when the price of an asset moves in the opposite direction of the OSC Indicator. For instance, if the price is making new highs while the OSC Indicator fails to do so, it indicates a potential reversal. Recognizing divergence can be a powerful tool for predicting market movements.

Benefits of Using the OSC Indicator

The OSC Indicator offers numerous benefits for traders, including:

- Enhanced Decision Making: By providing insights into market trends, the OSC Indicator facilitates better trading decisions.

- Risk Management: It aids in identifying potential reversals, allowing traders to manage risks more effectively.

- Flexible Use: The indicator can be used across various asset classes, from stocks to forex.

Best Practices for OSC Indicator

To maximize the effectiveness of the OSC Indicator, consider these best practices:

- Combine with other indicators for a more comprehensive analysis.

- Use multiple time frames to confirm signals.

- Regularly backtest strategies involving the OSC Indicator.

Common Mistakes When Using the OSC Indicator

Traders often make mistakes when using the OSC Indicator. Here are some common pitfalls to avoid:

- Relying solely on the OSC Indicator without considering other factors.

- Ignoring the importance of volume analysis in trading.

- Failing to adapt settings to personal trading styles.

Conclusion

In conclusion, the Thinkorswim OSC Indicator is an invaluable tool for traders looking to enhance their market analysis and trading strategies. By understanding its features, interpreting its signals, and applying best practices, traders can leverage the OSC Indicator to gain a competitive edge in the financial markets. We encourage you to explore the OSC Indicator further and incorporate it into your trading arsenal.

If you found this article helpful, please leave a comment below and share your thoughts. Don’t forget to check out our other articles for more insights into trading strategies and market analysis.

Thank you for reading! We look forward to seeing you back on our site for more valuable content.

Also Read

Article Recommendations

ncG1vNJzZmivp6x7tMHRr6CvmZynsrS71KuanqtemLyue9KtmKtlpJ64tbvKcGatoJmjuLC%2B0rCgpmWfqLButc2doJyZpKS%2Fb7TTpqM%3D