Understanding Your NC Tax Refund Status: A Comprehensive Guide

Are you eagerly waiting for your NC tax refund status? Navigating the world of tax refunds can often feel overwhelming, especially with all the potential delays and changes in regulations. In this article, we will provide you with an in-depth understanding of how to check your NC tax refund status, what factors can affect it, and tips to ensure you receive your refund in a timely manner.

North Carolina, like many states, has a specific process in place for handling tax refunds. Understanding this process is essential for taxpayers who want to stay informed about their financial matters. As we delve deeper into the topic, we will cover various aspects of the NC tax refund status, including eligibility, how to check your status online, and common reasons for delays. This guide aims to equip you with the knowledge needed to navigate the tax refund process efficiently.

Moreover, this article adheres to the principles of E-E-A-T (Expertise, Authoritativeness, Trustworthiness) and follows the YMYL (Your Money or Your Life) criteria to ensure that the information provided is reliable and beneficial for your financial well-being. So, let’s get started on understanding your NC tax refund status!

Table of Contents

Understanding NC Tax Refund

The NC tax refund is the amount of money that the North Carolina Department of Revenue (NCDOR) returns to taxpayers after the tax filing process. This refund is typically issued when a taxpayer has overpaid their taxes throughout the year, either through withholding or estimated tax payments. Understanding the process is crucial for taxpayers who want to ensure that they receive their rightful refunds.

Types of Tax Refunds

There are several types of tax refunds that taxpayers in North Carolina may receive:

- Individual Income Tax Refunds

- Corporate Income Tax Refunds

- Sales and Use Tax Refunds

Who is Eligible for a Refund?

Eligibility for a tax refund in North Carolina depends on various factors, including:

- Your total income and tax liability

- The amount of taxes withheld from your paycheck

- Any tax credits you may qualify for

Taxpayers must file their income tax returns to determine their eligibility for a refund. If you have overpaid your taxes, you will likely be eligible for a refund.

How to Check Your NC Tax Refund Status

To check the status of your NC tax refund, you can follow these simple steps:

Factors Affecting Your Tax Refund

Several factors can affect your NC tax refund, including:

- Filing Status: Your marital status and whether you are filing jointly or separately can impact your refund.

- Income Level: Higher income levels may result in lower refunds due to tax liability.

- Tax Credits: Eligibility for various tax credits can significantly increase your refund amount.

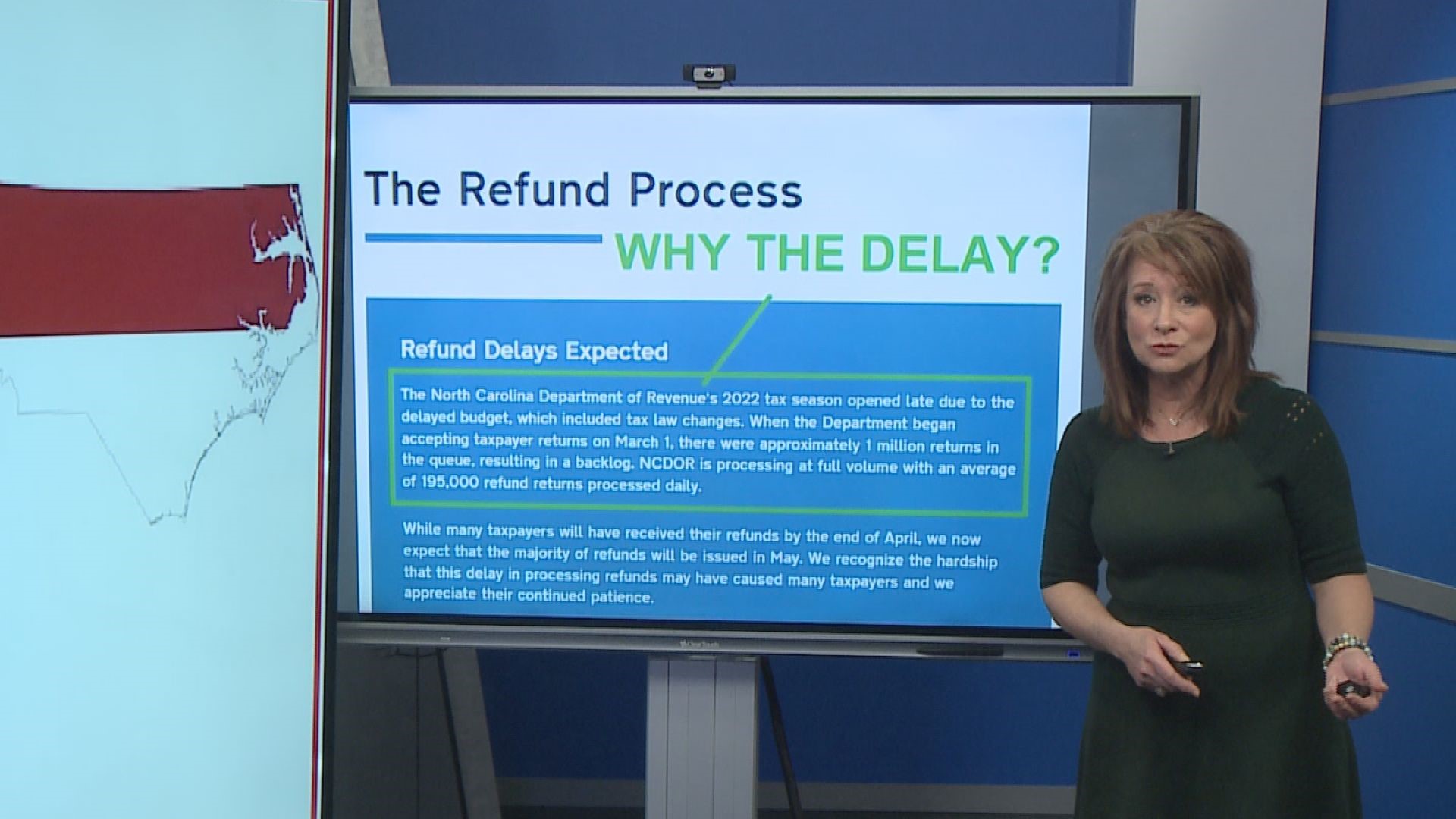

Common Delays in Tax Refunds

Understanding the common reasons for delays can help you be better prepared. Some typical reasons include:

- Errors on Your Tax Return: Mistakes or discrepancies can lead to processing delays.

- Incomplete Information: Missing documents or information can slow down the refund process.

- Fraud Prevention Measures: The NCDOR may hold refunds for additional review if there are signs of potential fraud.

Tips for Ensuring a Timely Refund

To ensure that you receive your NC tax refund in a timely manner, consider the following tips:

- File Your Taxes Early: The earlier you file, the sooner you may receive your refund.

- Double-Check Your Return: Review your tax return for any errors before submission.

- Use E-File: E-filing is generally faster and more efficient than paper filing.

If you have any questions or concerns regarding your NC tax refund status, you can contact the NCDOR directly. They provide various methods for taxpayers to get in touch, including:

- Phone: Call their customer service line for assistance.

- Email: Submit inquiries via email for documentation purposes.

- Online Chat: Utilize online chat features for quick answers to your questions.

Conclusion

In summary, understanding your NC tax refund status is essential for managing your financial health. By knowing the eligibility requirements, how to check your status, and the common factors affecting your refund, you can navigate the process with confidence. We encourage you to leave a comment below if you have any questions or share this article with others who may find it helpful. Remember, being informed is the first step towards financial success!

Thank you for reading! We invite you to explore more articles on our site for valuable insights into personal finance and tax information.

Also Read

Article Recommendations

ncG1vNJzZmivp6x7tMHRr6CvmZynsrS71KuanqtemLyue9WiqZqko6q9pr7SrZirq2hku6R505qvZqqVm8KvsIysq5qspah7qcDMpQ%3D%3D