What Is Unrealized Capital Gains? Understanding The Concept And Its Implications

Unrealized capital gains refer to the increase in the value of an asset that an investor holds but has not yet sold. This concept is crucial for investors as it impacts their investment strategies and tax obligations. In this article, we will delve into the meaning of unrealized capital gains, how they work, and their implications for investors.

Understanding unrealized capital gains is essential for anyone involved in investing, whether in stocks, real estate, or other assets. These gains can represent a significant portion of an investor's overall wealth, but they also carry certain risks and considerations. By the end of this article, you will have a comprehensive understanding of unrealized capital gains and how they fit into the larger picture of your financial planning.

In the following sections, we will explore the definition of unrealized capital gains, the difference between realized and unrealized gains, how they are calculated, and their tax implications. We will also provide examples to illustrate these concepts and discuss strategies for managing unrealized capital gains effectively.

Table of Contents

Definition of Unrealized Capital Gains

Unrealized capital gains occur when the market value of an asset exceeds its purchase price, but the asset has not been sold. This means that the investor has not yet "realized" the gain by selling the asset. For example, if you purchase shares of a company at $100 each and the current market price is $150, you have an unrealized capital gain of $50 per share.

Realized vs. Unrealized Capital Gains

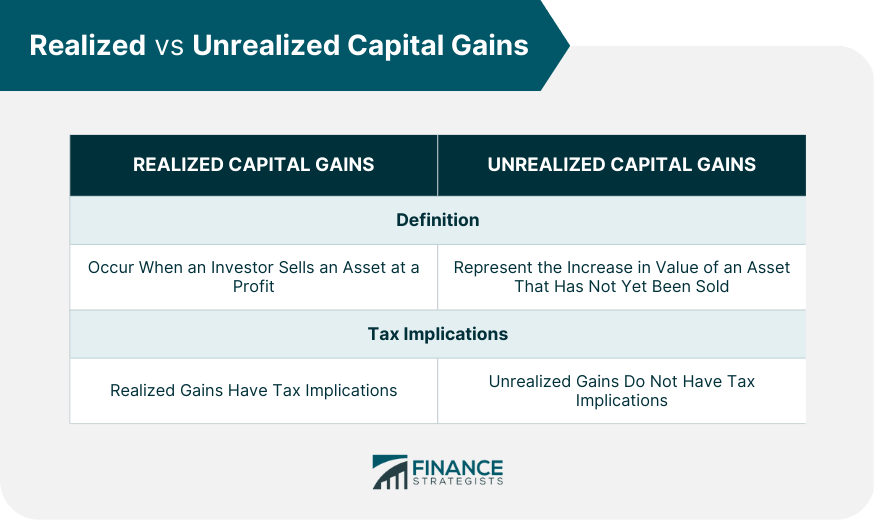

It is essential to differentiate between realized and unrealized capital gains:

- Realized Capital Gains: These gains occur when an asset is sold for more than its purchase price. The profit is "realized," and the investor may be subject to capital gains tax.

- Unrealized Capital Gains: As discussed, these gains reflect the increase in an asset's value that has not yet been sold. They are often viewed as paper profits and do not incur taxes until realized.

How to Calculate Unrealized Capital Gains

To calculate unrealized capital gains, you can use the following formula:

Unrealized Capital Gains = Current Market Value - Purchase Price

For example, if you bought 10 shares of stock at $100 each and the current market price is $150, the calculation would be:

- Current Market Value = 10 shares x $150 = $1,500

- Purchase Price = 10 shares x $100 = $1,000

- Unrealized Capital Gains = $1,500 - $1,000 = $500

Tax Implications of Unrealized Capital Gains

One of the critical aspects of unrealized capital gains is their tax implications. In most jurisdictions, unrealized gains are not taxed until the asset is sold. However, this can vary based on local laws and regulations.

Here are some points to consider:

- **Tax Deferral:** Investors can defer taxes on unrealized gains until they sell the asset, allowing for potentially significant tax savings.

- **Market Volatility:** Fluctuations in the market can impact the value of unrealized gains, which may affect investment decisions.

- **Tax Strategies:** Some investors may employ strategies such as tax-loss harvesting to offset unrealized gains with realized losses.

Investment Strategies for Managing Unrealized Gains

Managing unrealized capital gains is an essential part of investment strategy. Here are some strategies to consider:

- Diversification: Spreading investments across various asset classes can help mitigate risks associated with unrealized gains.

- Regular Monitoring: Keeping track of your investments and market trends can help you make informed decisions about when to sell.

- Tax Planning: Understanding your tax situation can help you optimize your investment strategy regarding unrealized gains.

Case Studies: Unrealized Capital Gains in Action

To illustrate the concept of unrealized capital gains, let’s consider a few case studies:

Case Study 1: Stock Investment

A tech investor buys shares in a promising startup for $50 each. Over the next year, the stock price climbs to $200. The investor now has an unrealized capital gain of $150 per share. If the investor chooses to hold the stock longer, they may benefit from further price appreciation, but also face the risk of a market downturn.

Case Study 2: Real Estate Investment

A homeowner purchases a property for $300,000. After several years, the property value rises to $450,000. The homeowner has an unrealized capital gain of $150,000. The decision to sell or rent the property will depend on the homeowner’s financial goals and market conditions.

Pros and Cons of Holding Unrealized Gains

Holding unrealized capital gains has its advantages and disadvantages:

Pros

- **Potential for Increased Value:** Holding onto assets with unrealized gains can lead to higher profits if the asset continues to appreciate.

- **Tax Benefits:** Investors can defer taxes on unrealized gains, allowing for better cash flow management.

Cons

- **Market Risks:** The value of unrealized gains can decrease, leading to potential losses if the market turns.

- **Missed Opportunities:** Investors may miss out on better investment opportunities by holding onto assets with unrealized gains.

Conclusion

Unrealized capital gains are an essential aspect of investing, representing the increase in the value of assets that have not yet been sold. Understanding this concept and its implications can help investors make informed decisions about their financial strategies. By recognizing the difference between realized and unrealized gains, calculating these gains accurately, and considering tax implications, investors can better manage their portfolios.

We encourage you to leave a comment below, share this article with others, or explore more on our site to enhance your understanding of investment strategies and financial planning.

Penutup

Thank you for reading! We hope this article provided valuable insights into unrealized capital gains. As you continue your investment journey, remember to stay informed and make decisions that align with your financial goals. We look forward to seeing you again on our site!

Also Read

Article Recommendations

ncG1vNJzZmivp6x7tMHRr6CvmZynsrS71KuanqtemLyue9KtmKtlpJ64tbvKcWawoJGpeqq%2FjK6lq52Roba7scNmmpqomamurXnGmqCnq16dwa64